Keir Starmer faces £4.25bn fiscal hit after benefits reversals

Sir Kerr Starmer detonated a hole of 4.25 billion pounds in his budget after he retracted the discounts to deficit subsidies and retirees, which increases the possibility of increasing taxes and destroying his government’s credibility with investors.

On Thursday, the UK Prime Minister gave rebel representatives about 3 billion pounds of concessions on the planned discounts of spending on social welfare, just weeks after he reversed the reduction of fuel payments in the winter for retirees at a cost of 1.25 billion pounds.

Starmer, who swept his position last July in a victory in the ground collapse elections, made his huge parliamentary majority an essential part of his stadium for investors, on the pretext that the UK government has stability and strength to make difficult decisions. Investors said on Friday that this argument was now undermined.

“This rotation will weaken the prime minister’s ability to make difficult decisions as his authority has been challenged by the Parliamentary Labor Party,” said Nicholas Trenddei, chief wallet manager at AXASET Management Arm.

He added that the decisions “will make it difficult for the chancellor to keep the financial hall to keep healthy and increase the probability of increasing taxes significantly in the autumn budget.”

In March, Chancellor Rachel Reeves left a razor of 9.9 billion pounds against her main financial rule to eliminate daily spending deficit by 2029-30.

Financial pressure may increase on Starmer and Reeves more, with weakness after the strong first quarter. Labor representatives may also be encouraged to push the government to cancel the maximum child on the benefits inherited from the last conservative government, a step that will cost 3.5 billion pounds annually.

Reeves also thought about alleviating the October budget raid on non -state taxpayers to stop the migration of the wealthy population, which would affect tax revenue expectations if the reforms reduce.

And Andy King, a former budget responsibility office, the UK Financial Agency.

“This is due to several billion pounds since the spring statement that must be found in the fall and there is a lot of other opposite winds that must also be treated,” said King, who is now working in Flint Global Consulting.

He added that the other autumn budget that provokes taxes was “increasingly possible.” “There is room to be a material number.”

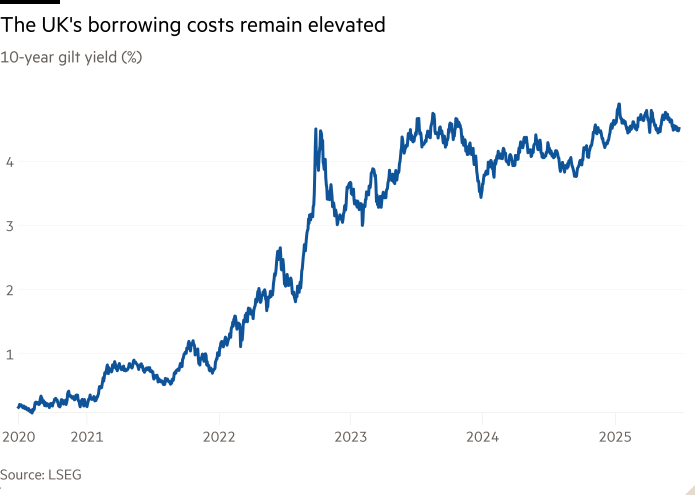

The 10 -year -old borrowing costs in the United Kingdom reached 16 years old over 4.9 percent in January, amid global bond sales and concerns about the financial position in the United Kingdom, before declining in recent months. Gilts was intellectually weaker on Friday, which prompted the return for 10 years, an increase of 0.03 degrees Celsius to 4.50 percent.

“The market participants have largely priced the possibility of increasing taxes in the autumn budget, and reinforces the Mujbah Al -Rahman, the manager of Europe at Eurosia Group in the Consultance Eurasia Group Group,” said Mujtaba Al -Rahman, Managing Director of Europe at the European Consulting Group.

He added: “The markets clearly see that the government’s financial strategy is some chaos and will require an additional correction of the session later in the year.”

Starmer said his social welfare reforms are designed to treat 2.8 million people in the UK who have a long -term health condition that prevents them from working.

The Labor Party government was hoping to save 4.8 billion pounds annually by reducing social welfare payments, but party representatives were wandering to take money from the disabled disabled.

Analysts at the Resolution Corporation and the Institute of Financial Studies said that the settlement made by Starmer on Thursday can reduce the sacred savings by about 3 billion pounds annually.

Starmer offered reductions to the main deficit subsidy in Britain to the new demands after November 2026, increased health payments under a different benefit in line with inflation for the current demands, and accelerating a package of recruitment support of 1 billion pounds.

He conducted a rough decline after more than 120 representatives of the Labor Party pledged to vote on legislation in his second reading next Tuesday.

Starmer said on Friday that he was “truly pleased” that the government was able to move forward in the bill. “We talked to colleagues who gave strong representations, and as a result we have a package I think it will work.”

Some prominent rebels welcomed climbing, including Meg Hiller, head of the chosen treasury committee, who said: “This is a good and practical compromise and shows that the work government has listened.”

However, dozens of representatives of work against legislation are still expected to vote. Simon Obsseer, a NHS doctor who was first elected in 2024, said he still could not vote for the bill. “The legislation of our interest system is not the way to solve this,” he said. The rebels need 83 Labor Party representatives and opposition parties to defeat the government.

One of the concerns between hard -line rebels and disability groups is that the government will create a “bilateral” system where new applicants will be dealt with PIP more harshly than the current recipients.

“The government listened to deputies who support the principle of reform, but they are concerned about the frequency of change,” said Downg Street on Friday. A spokesman added that the reforms are still “meaningful” and said that it is “not customary” that you have different PIP prices.

Former Minister of Labor and Pensions told Lord John Hutton that the BBC Starmer has moved from the pledge to serve the “first country” to focus on “party administration”.

The Starmer government has not detailed how changes in its plans will be funded on social welfare payments and winter fuel, other than saying that there will be no “permanent” increase in borrowing.

Discounts in spending will be difficult because the cabinet that recently determines the budgets of departments during the next three years after reviewing painful spending. Raising taxes will also be politically difficult. Reeves is still struggling with misery due to tax increases of 40 billion pounds in the budget last year, and has pledged not to raise taxes on “working” people.

The Conservative Party leader, Kimi Badnouch, said that the Labor Party had created a “black hole with billions of pounds that could only mean higher taxes or borrowing.”

Mark Daving, chief investment official for fixed income at RBC Bluebay Asset Management, said the Starmer government suffers from “financial slipping”.

The government may have to raise taxes in order to “avoid a recurrence of anger anger”, when it ignited the mini budget in former Prime Minister Liz Trus for the year 2022 the gold market crisis.

2025-06-27 17:14:00