Does Moody’s US downgrade matter?

Stay in view of the free updates

Simply subscribe to Capital markets Myft Digest – it is delivered directly to your inbox.

On Friday, Moody’s pulled the trigger and stripped the United States from its last classification – as it reduced one degree of AAA to AA1.

But does it matter?

We looked at the effects of the classification two months ago, when Moody’s is still determined to ignore Neon and Mira Sixty Signs Wall writing.

From the perspective of the stock market, who knows? We have no idea if it is important, or it will be important when opening on Monday. Certainly, the reduction in sovereignty in the United States of America in August 2011 pushed the worst day in the decrease in stock prices in the United States because the global financial crisis (it is Muslim at the time). But the market recovered quickly. Perhaps this was people stunned about what might mean lowering the category of financial plumbing.

So, does the retreat to the financial plumbers are important this time? From a mechanical perspective, the answer is certainly “not at all.”

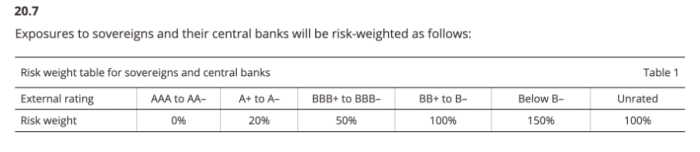

It is unlikely to be affected by the accounts of the weighted capital assets for banks by changing the classification. This is because the organizers do not tend to distinguish between AAA and AA1 when putting the weight of capital risk. For example, this is the way BIS determines its uniform approach to credit risk because it applies to individual claims to calculate its weighted assets with regard to the dictates:

Moody’s could have reduced the three classification-from AAA to AA3-nothing changed on this front.

What about the guarantees management? A note from Barclays on Friday night to the effects:

For side purposes, it is unlikely to reduce the classification to AA1 effect. For example, DTCC and CME refers to the class of assets as an American wardrobe and the cuts are a function of maturity and type of safety (Tips/FRNS) but not categories. In LCH, the reduction is unlikely to change the AA1 to change. For example, USTS and Gilts are similar hairstyles, even with the last classification.

Moreover, they believe that this step will not lead to movements at the end of the short curve because:

Legislation since the financial crisis has reduced the use of explicit classification instructions in the investment states.

Therefore, they do not expect waves of asset sales of about $ 4.5 trillion in the Treasury and the Ministry in the money boxes.

Stay away from financial markets, the classification reduction may be important to Moody’s itself. If the S & P Global Transitions in 2011 is anything you should go through, the company will be on an approximate trip. After a reduction of the S&P more than a decade ago, US Treasury Secretary GEITHNER threw a little from a general fluctuation, and the director Michael Moore Obama called for the arrest of the company’s CEO. As we wrote in March:

Someone has appointed a plane to fly a banner’s rating agency offices that all should be expelled, and that a handful of local governments has ended their work with the company.

Meanwhile, apparently unrelated, the Ministry of Justice launched an investigation at the S&P. Within a few weeks, Deven Sharma CEO left the company. When matters moved from being just an investigation into an actual federal suit worth $ 5 billion to mislead the alleged banks about the credibility of their rating before the 2008 financial crisis, the S&P described this direct revenge to reduce the classification.

After the classification, Moritz Kraemer – Director General of the Global Classification of Sovereign Classification at the S&G Global Ratings – wrote on LinkedIn that the risk of revenge was real:

In the United States, evaluation agencies are organized and licensed by the Securities and Stock Exchange Committee). Since things are standing in America today, we must wonder whether the Securities and Stock Exchange Committee can act independently of the desires of the White House. Remember that the former SEC Council Chairman, Gary Gensler, resigned on the opening day, which led to the road to Trump Acolyte. Will Trump angry at reducing the United States (which he will definitely take personally) to the extent that he will demand his driver from the body and the imposition of revenge on Moodyz.

We have already seen that the White House rejects the analysis, and came out in Mark Zandy, the chief economist in Moody. Stephen Chiong, assistant president, tweet: “Nobody takes his” analysis “seriously. It has been proven that he was repeatedly wrong.”

As stated in Mainft, Zandi was not the author of this report and working in Moody’s Analytics, a separate part of the company that is not part of its business in the classification.

In general, while the first -class reduction of AAA may not have huge effects on the market, it is still important.

Financially, Moody’s has long expected measures close to the basket to the United States. Upon reaffirming the AAA classification in March, he wrote that the AAA classification of the country instead bowed on “the extraordinary economic power and the unique and central roles of the treasury bond market in the field of global finance.”

In the previous classification report, which reaffirms the AAA classification in November 2023, Moody’s:

The weakening of institutions and the power of governance, such as the deterioration in the effectiveness of the policy of monetary economics, macroeconomic economy, or the quality of legislative and judicial institutions, can adhere to classification.

The world has moved since 2023, and Moody’s distinguishes the market.

2025-05-17 12:04:00