Magnificent 7 isn’t that magnificent: 5 stocks have underperformed the market this year

S&P 500 futures rose 0.44% this morning after the index lost 1.07% on Friday, one day after setting a new all-time high on December 11.

The index is still up 16% year to date, an above-average performance for US stocks. Analysts have long complained that the index is dominated by “Magnificent 7” technology stocks. Between October 2022 and November 2025, roughly 75% of the gains in the S&P 500 came from this handful of companies.

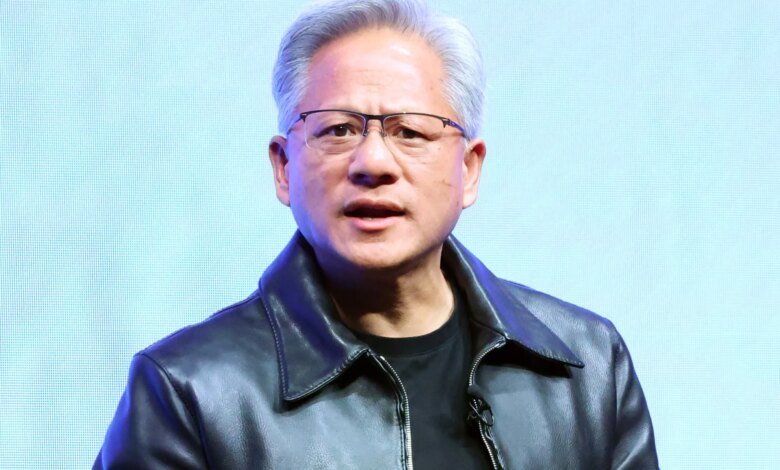

But as we approach the end of the year, only two of these stocks — Alphabet and Nvidia — have managed to beat the market as a whole, year-to-date:

What appears to be happening is that investors are choosing between winners and losers in technology, rather than simply rushing into the index or technology stocks as a whole. This is probably a healthy thing to do if you’re worried that AI spending is creating a bubble in tech stocks.

The best example of this is Oracle, which is up 14% year to date but is down 42% from its September high. Investors did not like the additional debt Oracle took on, with increasingly widening interest spreads above risk-free benchmarks, to finance the AI build.

Wall Street is not yet ready to declare the AI gold rush a bubble. “If this is a bubble, it is still in its early stages,” Adrian Cox and Stephane Abrodan, analysts at Deutsche Bank, said in a recent research note on artificial intelligence.

So far, capital spending and revenues are real: they’re up and down Alphabet and Nvidia, which is why those companies’ valuations are so good. “These charges are driven by large, established technology companies with multiple revenue streams, which pay for their data center investments mostly from free cash flow and from which they generate immediate returns from enterprise customers,” Cox and Abrodhan wrote.

“We believe reports of a bubble are exaggerated (for now),” they said.

Elsewhere: Asian markets fell today but markets in Europe were largely higher in early trading. The STOXX Europe 600 Index is up 0.63% at the time of writing; The British FTSE 100 index rose by 0.74%.

Here’s a quick snapshot of the markets before the opening bell in New York this morning:

- Standard & Poor’s 500 futures It rose 0.44% this morning. The last session closed with a decline of 1.07%.

- Stokes Europe 600 It rose 0.63% in early trading.

- UK FTSE 100 index It rose by 0.74% in early trading.

- Japan Nikki 225 It decreased by 1.31%.

- China CSI 300 Decreased by 0.63%.

- South Korea Cosby Decreased by 1.84%.

- India Stylish 50’s Decreased by 0.12%.

- Bitcoin It was priced at $89,000.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-12-15 11:56:00