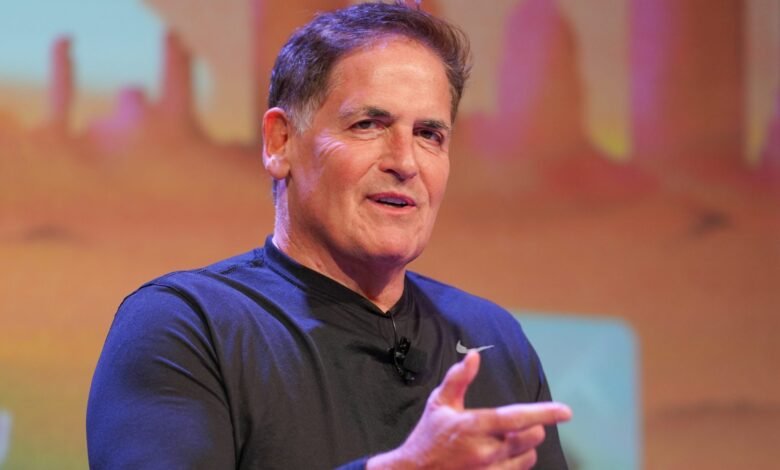

Mark Cuban says consumers may actually see lower prices due to tariff uncertainty as companies deal with the aftermath of stockpiling goods

- Many economists also warn of the dependency consequences of definitions, Billionaire Mark Kobe believes that the uncertainty surrounding definitions may actually lead to low prices in some cases. “Companies may try to rid themselves of the stock they stored as a result of the threats of customs tariffs, and the costs decreased to” return to cash. “

The billionaire investor, Mark Koban, said that there is no cause that does not cause definitions after the shock of stickers expected by many consumers.

the shark Star said on social media on Sunday that inflation did not rise as economists predicted because the companies that were stored on imported products before the definitions now focused on getting rid of this stock, even reducing prices to cleanse the goods in exchange for some rapid cash flow. Kobe said he sees this phenomenon in all his product -based companies.

“The contrast in definitions made it impossible to know how to manage costs,” Kobe said on a social media. “So, you are doing everything you can to cleanse the stock and return to criticism. And seize your chances of definitions that are not as much as you are afraid.”

In fact, the PCE report of the Ministry of Trade from last week indicated that inflation slowed to an annual average of 2.1 % in April from 2.3 % in March. This is despite the investor and economists’ concerns that companies will decrease the cost of definitions for consumers, which raises the prices of goods, which will lead to increased inflation.

Kobe said that companies that manage supply chains affected by the definitions that were withdrawn forward from the goods to enjoy taxes. Data tracking increases in shipments were found before the definitions were carried out. These increases coincided with companies that store goods before they are defined. Since then, traffic has decreased in American ports.

But there is a potential negative aspect of companies sitting on many commodities, as Kobe has argued.

He said: “They see the customs tariff at work and stop it again, so they do not know the time when their stock will get the value they expect.”

In order to pull the charges forward – sometimes for three to six months, according to the Cooper – may have got loans. But with a lot of uncertainty about definitions, companies may not want to be burdened with debt.

“So they don’t raise prices,” Cuban said. “In fact, they may deduct some of them as a way to remove stock, renew money, or pay expensive loans.”

Cuban did not respond to luckRequest to comment.

Why lower prices are not good news

Just because inflation and prices are lower than expected, it does not mean that it is good news for companies that move definitions or economics on a wider scale.

“Nothing of the above is positive,” said the Cuban.

In order to store inventory, some companies may borrow the cash on the terms of unfavorable loans or use current funds on hand. While fortunate companies may be able to make deals with manufacturers, who know the risk of definitions and are able to provide better prices, other companies may not be very fortunate.

By obtaining huge loans to withdraw shipments forward, companies may have lost the ability to gain interest or invest in other parts of their business. Moreover, they may have to pay interest, sometimes between 10 % and 20 %, on the loans they got.

“These are not just small companies,” Cuban said. “This is all the companies facing this.” He added that this is the reason that walmart may increase prices in the future.

Kobe has already warned of the long -term consequences of president Donald Trump’s definitions on social media, even indicating that she could contribute to an economic crisis.

“If the new definitions remain in place for several years and are applied and enlarged, and [the Department of government Efficiency] Kobe said in April:

This story was originally shown on Fortune.com

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-06-02 17:24:00