Prediction Pulse: Lisa Cook faces Trump challenge, Trump Jr. plays both markets, and Taylor Swift turns Polymarket into a payday

This week in the prediction markets, Donald Trump Junior somehow secured a seat on both sides of the table. The man officially joined the advisory ranks in Polymarkket while he was also lighting in Kalshi. One imagines a little embarrassing conversation when both companies end at the same cocktail party.

Polymark issued the great announcement that Trump Junior was not only in the consulting council, but that his investment company, 1789 Capital, put money in the company. In Kalshi, we reminded that Trump Junior has been in a consultative role since January, although Axios had noticed that this disturbed this paid instead of investing. In other words, cash one place, and other consulting fees.

Excited to welcome Donaldjtrumpjrfund @1789capital As a strategic investor in Polymarket before the launch of the United States.

It will also join our advisory council.

Assemble the avenger. We go home

pic.twitter.com/w6mdzuocxv

– Shine Coblen

(Shayne_coplan) August 26, 2025

If you are confused about how the person himself can advise the largest players in a specialized industry that flourishes on the next sneezing in congress, you are not alone. But again, we live in an era in which conflicts of interests are more than the beginning of a conversation than being professional.

Polymarket, for its part, is preparing to re -introduce it to the United States after a courtesy deadline from the commodity futures trading committee. CFTC cleared the company in 2022 by allegedly operating the non -regulating prediction markets, which are primarily considered the financial organizer to send you to your room without candy.

Now, with its acquisition of a licensed stock exchange this summer, Polymarket hopes to return to the United States within weeks, or perhaps the fall if the papers move quickly.

The only thing that is difficult to predict from the upcoming elections is how Trump Junior plans to balance his new dual life. Fortunately, there are two companies ready to allow you to bet on it.

What is in the prediction markets for this week?

Like

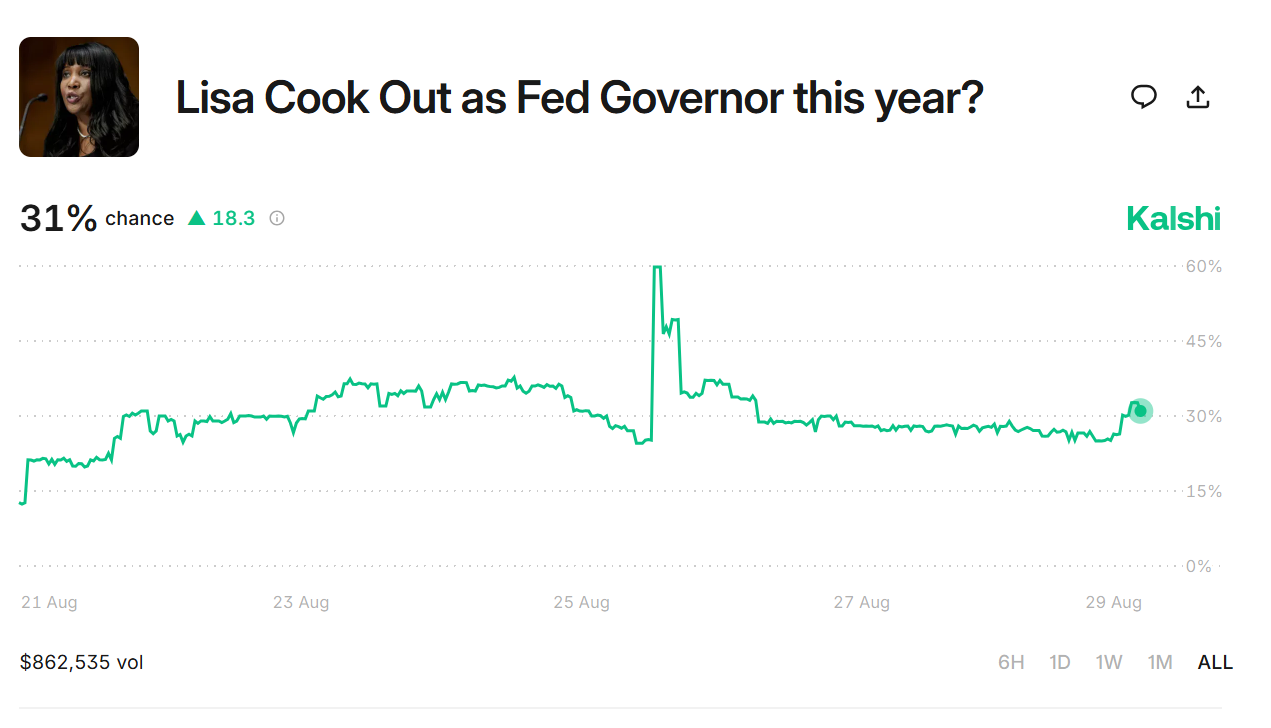

For only known reasons for financing deities, Kalshi users are glued again on the federal reserve. Last week, interest rates, this week, were whether the Federal Reserve Governor Lisa Cook would be operated before the end of the year. The market gives it a 31 % chance, which is the prediction market that talks about “perhaps not, but it will not be fun if.”

The drama stems from President Trump’s announcement that he shot Cook, accusing her of defrauding a mortgage. In the major traditions of Trump’s data, a social media speech was accompanied by his alleged sins.

Only in: Federal Reserve Governor Lisa Cook, who was “launched” by Trump, says she will continue to perform her duties

Only 39 % is an opportunity abroad this year pic.twitter.com/xRqjoaouzh

– KALSHI (KALSHI) August 26, 2025

However, the law says that federal conservatives cannot be removed only for the reason, and it is usually explained as a serious misconduct, not contrary to mortgage papers. Legal experts are lining up to politely that the president will face a difficult time to make this stick.

Meanwhile, KALSHI got an unexpected marketing batch from President El Salvador Nayeb Bokil, who was delighted from the podium market about whether Bitcoin Stach would reach one billion dollars by the end of 2025.

I can do the funniest thing now … https://t.co/82LENA4HGN

– Nayib Bukele (nayibbukele) August 27, 2025

Kalshi has jumped from 20 % to 38 % after Bukele hinted that “he could do the funniest thing at the present time”, a phrase that undoubtedly made the Minister of Finance and the International Monetary Fund to reach aspirin.

It should not be superior to it, Polymarket soon listed the betting version of the bet, where the possibilities sit 43 % higher. It is clear that nothing stimulates the global prediction market industry just like a loving bitcoin and usually Twitter.

Polymarket

It should not be left outside the Lisa Cook drama, the Polymarket has its own market about whether it will come out by the end of 2025. The bets give it only 28 %, which is a slight degree of less than taking like. Cook herself cleaned Trump’s dismissal speech, on the pretext that the removals “for the cause” relate to the actual misconduct in the office instead of anything in its previous real estate papers.

Polymarket merchants also do not see a little opportunity to assemble Jerome Powell aside in 2025, as they seek only 10 % early outlet. The message is clear: Investors believe that the independence of the central bank has a stronger spine than it indicates the main headlines.

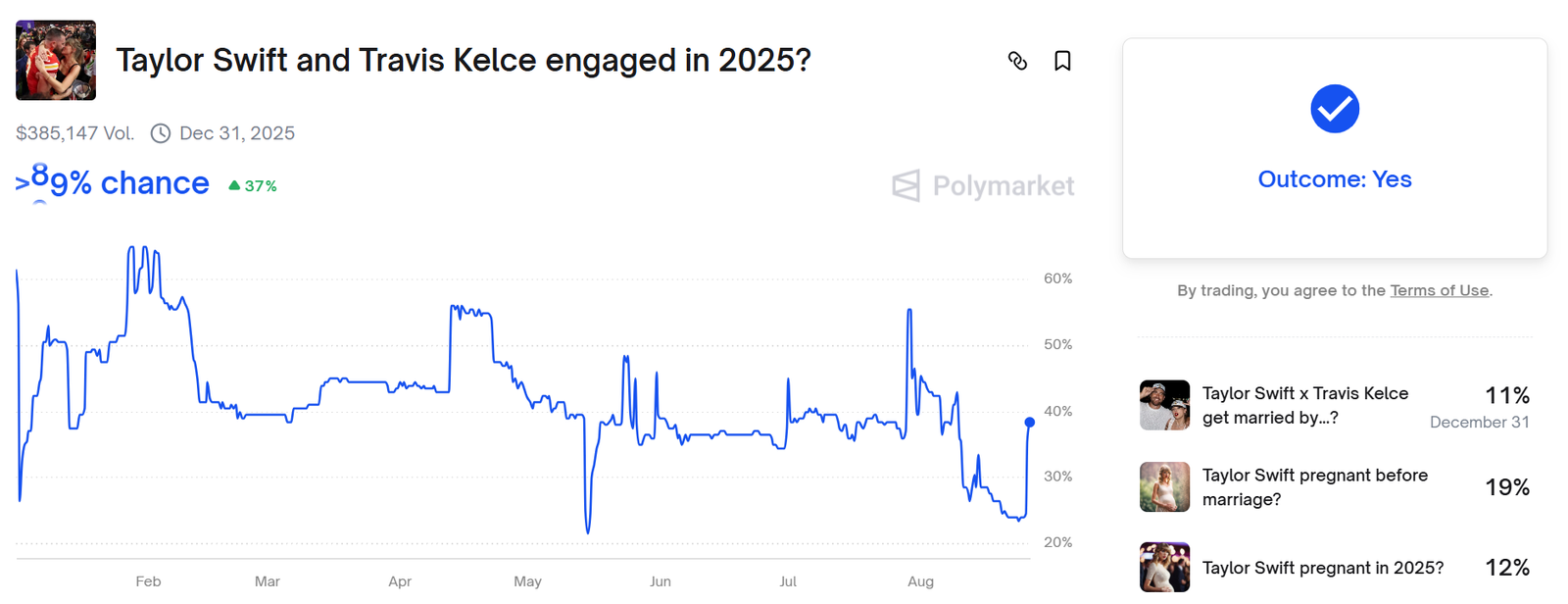

But this week this week, the jewel of the crown this week had no relationship with the Federal Reserve and everything related to Taylor Swift’s Ring. One user, named “Romancebol”, saw writing on the Instagram wall in front of us. Less than 24 hours before the Swift and Travis Kelce announced their participation, RomanticPaul was loaded on “Yes” shares from the spouses that link the knot by the end of the year.

By the time when the couple posted coordinated personal photos, he was sitting on a profit of 153 % of more than $ 3,000. The speed with which the axial polymearite depends on betting on the timelines for pregnancy that Swifties may outperform Wall Street in its use of alternative data.

Of course, the polymers cannot resist the roaming in the angles that are darker than speculation. The platform now offers bets on whether the Houthi rebels will successfully attack another ship by August 31.

The market barely appeared two weeks after the killing of strikes in the real world at least five of the sailors, which led to the anger of both human rights and shipping groups. Critics call hateful contracts, accused of normalizing violence.

Despite the condemnation, the volume of the folder has already reached $ 23,000, as traders buy “yes” shares for fifteen cents.

It is the type of bet that states that prediction markets are not just mirrors of general curiosity, but also one of its worst pulse. For every romance that rides a wave of celebrity gossip, there are others ready to bet on whether the missiles will fly.

Distinguished Image: Canva / Federal Reserve / Grok

Beyond prediction pulses: Lisa Cook faces Trump’s challenge, Trump Junior is playing both markets, and Taylor Swift turned the polymer to the day of pushing first place on reading.

Don’t miss more hot News like this! Click here to discover the latest in Technology news!

2025-08-29 14:00:00