Moody’s Mark Zandi says some U.S. Roughly half of US states are effectively in a recession and ‘hanging on by their fingertips,’ Moody’s chief economist says

Everything must look good in the economy. GDP rose by 3.8% last quarter, and unemployment remained at a steady level of 4.3%. So why does it seem so difficult?

The short answer is: Depending on where you live and who you are, your surroundings are stagnant.

According to Moody’s analysis, 22 US states are witnessing a contraction in their economies. Meanwhile, only 16 countries are experiencing economic growth, while 13 are classified as “treading water.” However, the states that contribute the most to US GDP—California, Texas, and New York—are all in the clear, pushing the country’s overall growth into the green as a result.

But for those who don’t live in the wealthier states (and, in fact, aren’t at the top end of the income scale within those areas), things “don’t look so good,” according to Moody’s chief economist Mark Zandi.

Zande said luck In an exclusive interview, low-income families are “hanging on by their fingertips financially.” He explained: “They’ve got a job, and that’s why they’re still able to spend and stay involved in the economy, but increasingly…the grip seems more tenuous because no one is getting hired. You can keep that up for a while, but you can’t keep it forever. If layoffs go up, the lower middle income group is going to get hurt — and they don’t have options because they don’t have a lot of saving.”

“They have debt: they have car debt, they have student loan debt, and maybe, if they’re lucky, they have a mortgage, but they’re going to suffer, and their world is going to descend into recession very quickly.”

In the absence of federal data during the current government shutdown, private surveys have painted a picture of consumer vulnerability. The Conference Board’s US Confidence Survey conducted at the end of September found that, by income group, those at the bottom end ($25,000 to $35,000 annually) feel worse about the economy now than they did when the survey reached the low average in April of this year. Furthermore, just under 20% of respondents said it is difficult to get jobs, and 25% expected the market to become more difficult.

In fact, Zandi previously explained that the fortunes of the United States are “tied” to those of the wealthy because they are the only consumers who spend before inflation.

While job losses and high unemployment rates are usually the hallmark of a recession, Zandi said an argument can be made that America’s lowest earners are living in a recessionary environment — no matter where they live in the country: “They don’t have any assets, and they’re in a very fragile position, and that this feels like a recession and everything but: ‘I got a job.’” And the thing that’s becoming more apparent is that people’s wage growth At the bottom of the distribution it is now also lagging.

Zandi said that everyone except those in the top 20% of earners is not “quite good” about the economy, and added that the margin of error in employment is small: “The way people look at their economy, their finances, is completely consistent with a recession — the difference here is that they are not losing their jobs.

“Having said that, our unemployment rate was 4.3%… And even in a recession, our unemployment rate was 5 or 5.5%, so we’re talking about a percentage point, about 1.5 million people. That’s not a lot of people, right? So you could argue that this is not a good test of whether you’re in a recession or not.”

Regional collapse

Regionally, the District of Columbia is on the steeper end of the recession spectrum, which is to be expected, Zandi said, because of the massive federal layoffs and funding cuts this year, now exacerbated by the government shutdown. These issues are also slowing the economies of neighboring states like Maryland and Virginia.

Other areas trending in the red likely did so, too, Zandi said, because they are home to industries affected by the White House policy: “A bunch of other states rely on industries that have been hit hard by tariffs and even restrictive immigration policy. It’s an industrial base, which is agriculture, transportation, distribution, mining — those would be some of the Midwestern states — even Georgia, which is the state that surprised me the most because Historically this has been a stronger case.

“But it has a very large industrial base, a large port, a lot of agriculture, and in the greater Atlanta economy, it has seen very significant weakness and outflows of people just because I think costs have gone up significantly, they are not quite as affordable as they were in light of all the pandemic-related migration into the state and the weak housing market.”

One of the most surprising elements of the data is that the spread of the recession extends from coast to coast, rather than focusing on one area of contraction or another — and with that in mind, Zandi said the broader fate of the U.S. economy lies at two ends of the country: California and New York.

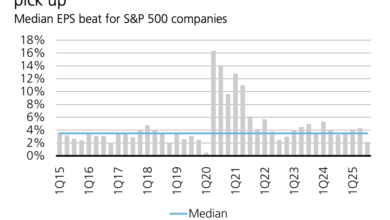

“These two countries are walking on water,” Zandi said. “They are big countries and if they go into the red zone, it will probably take the national economy with them into recession. If they emerge and find their way into the blue zone, I think we will be able to avoid deflation.” Regarding the indices he monitors in either state, he added: “In New York, the thing I would focus on is the S&P 500 because it’s so rich, and the financial services sector is so important to New York City’s great economy — if that falters, you know New York is going to be in the market.

“In California’s case, it’s technology and also the S&P 500, because that goes into wealth and that goes into what moves capital among AI companies that are really thriving.”

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-10-09 14:16:00