New home sales fall to seven-month low in May; supply increases

Lucia Motikani

WASHINGTON (Reuters) -Cases of one family homes in the new United States decreased in more than three years in May, where high real estate mortgage rates increased, economic uncertainty, and raising the supply from indirect homes in the market to the highest level since late 2007.

The largest decrease in the expected sales that the Ministry of Commerce reported on Wednesday added to the weak construction of homes and sales for the previously owned homes last month, indicating that housing will be offered from the gross domestic product in the second quarter after it was neutral in the quarter of January to the quarter.

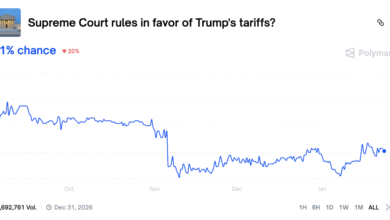

Inventory swelling and increasing costs due to president Donald Trump’s tariff for imported materials, including wood, steel and aluminum, restricts the ability of builders on new housing periods. Incentive builders, including price cuts, offer to attract buyers.

“While construction incentives may prevent a sharp decline in new homes sales, we do not see any real trend of sales in the coming months, given our expectations for the high mortgage rates and the reduction of the labor market,” said Nancy Vandin Hoten, the American Economic Economic Economy Economic, said.

The Ministry of Commerce Statistics Office said that the sales of the new homes decreased by 13.7 % to an annual average seasonal rate of 623,000 units last month, which is its lowest level in seven months. The decline was the largest since June 2022.

April sales pace to 722,000 units from 743,000 units previously reported.

Reuters expected economists, which make up about 13.4 % of US home sales, decreased to a rate of 693,000 units. New homes sales, which are calculated in signing the contract, volatile on a monthly basis and subject to large reviews.

6.3 % decreased yearly in May. Low sales were mostly between completed homes.

“This trend is likely to continue with the sale of the builders through the current stock,” said Veronica Clark, Citigroup economist, said. “The sales of homes where the construction did not start remains very low, indicating a little future support for housing.”

Sales last month decreased by 21.0 % in the densely populated south. They decreased 5.4 % in the West and decreased 7.1 % in the Middle West. But sales rose 32.1 % in the northeast.

High borrowing costs

Real estate mortgage rates are high along with US Treasury revenues amid the increasing economic uncertainty caused by import duties, prompting the Federal Reserve to stop the interest rate reduction cycle. The President of the Federal Reserve, Jerome Powell, told the legislators on Tuesday that the comprehensive customs tariff may begin to raise inflation this summer and reiterated that the US Central Bank was not in a hurry to resume discounts.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-06-25 14:56:00