Nostalgia for manufacturing will make the US poorer

This article is a copy on the site of the Free Lunch newsletter. Excellent subscribers can subscribe here to get the newsletter every Thursday and one. Standard subscribers can upgrade to installment here, or explore all FT newsletters

Welcome to your return. Now that Donald Trump has stopped his “mutual” identification plans (as expected in the newsletter last week), this edition will cancel the agenda of the broader American president to turn America into a “manufacturing force”.

In his speech “Liberation Day” on April 2, the Supreme Commander, retired car colleague, Brian Banbeker, called for a few words: “I saw the plant after the plant after the plant in Detroit. [The president’s tariff] Policies will return the product to these unexploited plants. . . I can’t wait to find out what is happening three or four years on the road. “

How can one discuss this point of view? This is what I will try to define here.

First, sympathy. Over the past four decades, manufacturing functions have decreased in America. Competitive imports from abroad contributed to the closure of factories, and many previous industrial areas failed to renew. (I recommend Peter Santinilo channel on YouTube, which documents life in these American provinces.)

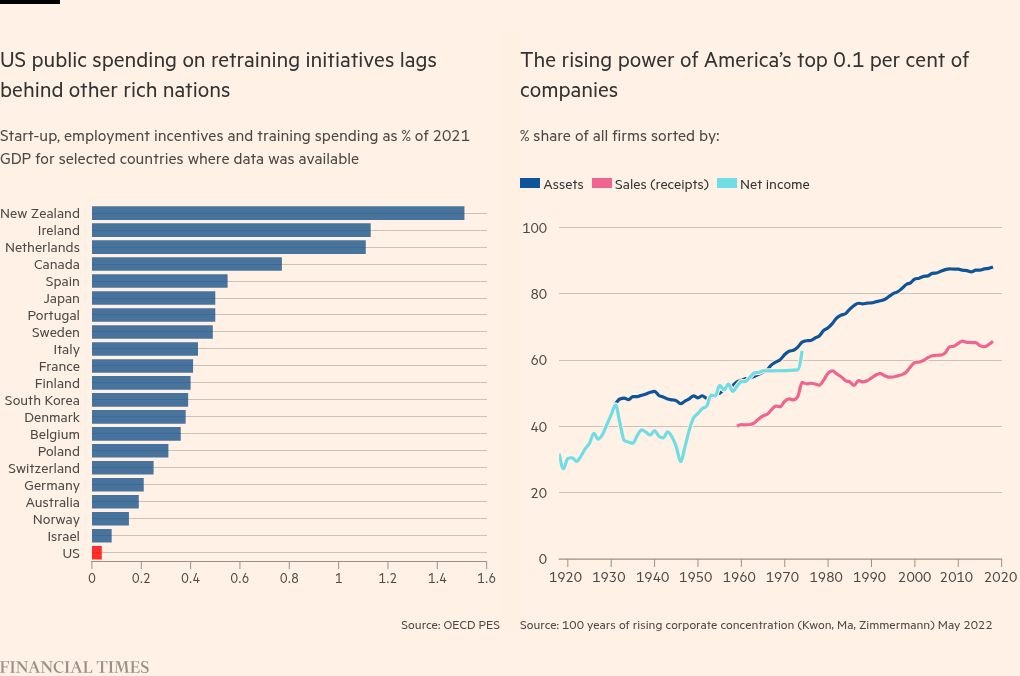

At that time, income inequality increased in the United States. The most rich in capital has increased its share of the total wealth.

The research conducted by Jim Reed, the head of Deutsche Bank, finds that the ratio of wealth to American income tends to track international trade as a share of global GDP over time.

“[This potentially reflects] Benefits [of globalisation] He wrote in the client’s memo: “The acquisition of shareholders through the most efficient global supply chains, a wider market, and the arrival and influence of low -cost workers in emerging markets,” wrote in a client’s memo: “This has pressed the advanced market workers, especially low -skilled workers.”

In fact, US capital markets have operated the reality of the global protection agenda in America. But the president used the stock market to strengthen his platform: “I am proud to be head of workers, not a pig; the president who stands on the main street, not Wall Street, who protects the middle class, not the political class.”

Cold manufacturing attractiveness, then, clear. But to support the president’s plans, one must also believe that America can, and it must, to restore the functions of the heavy labor factories, and that the customs tariff is the best way to do this.

Trade Minister Howard Lootnick clarified the ambition in an interview with him recently: “The army of millions and millions of people who flow into small nails to make iPhone, this type of things will come to America.” (It is worth noting that Trump is exempt from smartphones and other consumer electronics from his “mutual” definitions on Friday, but the duties of the sector in business.)

Either way, if the goal is to re -create a scale and specialize in developing world factories, the United States will need workers and capital.

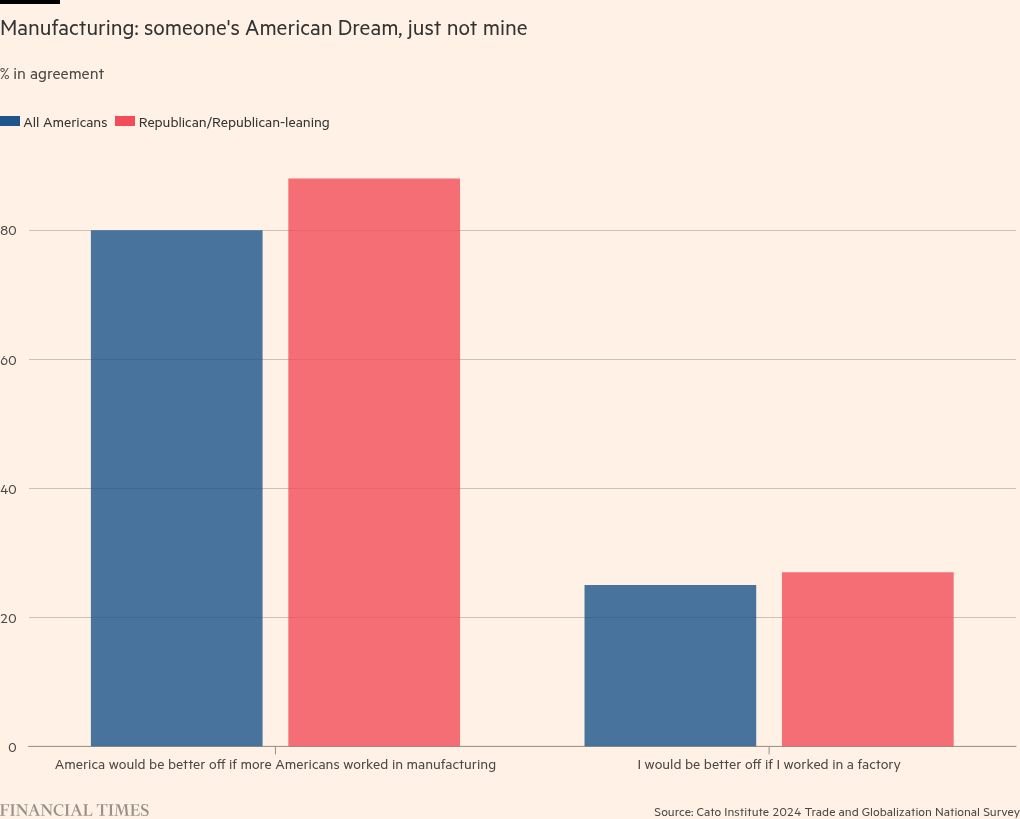

But few Americans want to go to industrial work. CATO 2024 survey found that only one in four believe they would be better at a factory about their current work. (Many Trump’s “middle class” works in the unproductive sectors today.) Management is also hostile to immigration.

As for capital, the owners of factories in America by raising import duties have its limits. Due to the costs of transferring production to the United States, investors will need employment, trusted access to local input chains and clarity on the period in which definitions will remain in place. They are all in a deficiency in the offer.

To measure, take Apple. Dan Evz, an analyst in a Wedbush, estimated that the iPhone manufacturer will need at least three years and only 30 billion dollars to change the ten supply chain from Asia to the United States.

The administration believes that this is a “transitional cost” on the way to restore the jobs of blue collars. As Pannebecker’s comments indicate, some are ready to give time.

Even if some factory’s functions return to America, my question to Trump and his supporters is the cost they want to pay for that.

It is true that some factory functions have been lost due to the use of external sources (although automation played an important role as well). But focusing on this loss-and seeking to reduce commercial openness-blocks the largest benefits on the economy level, which has arisen due to this.

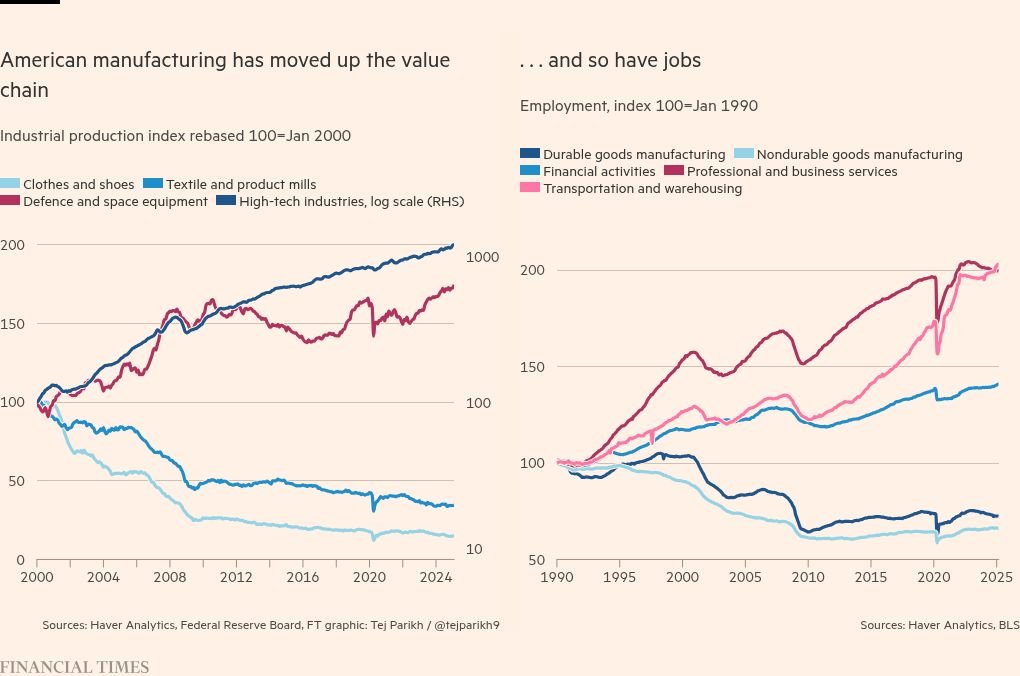

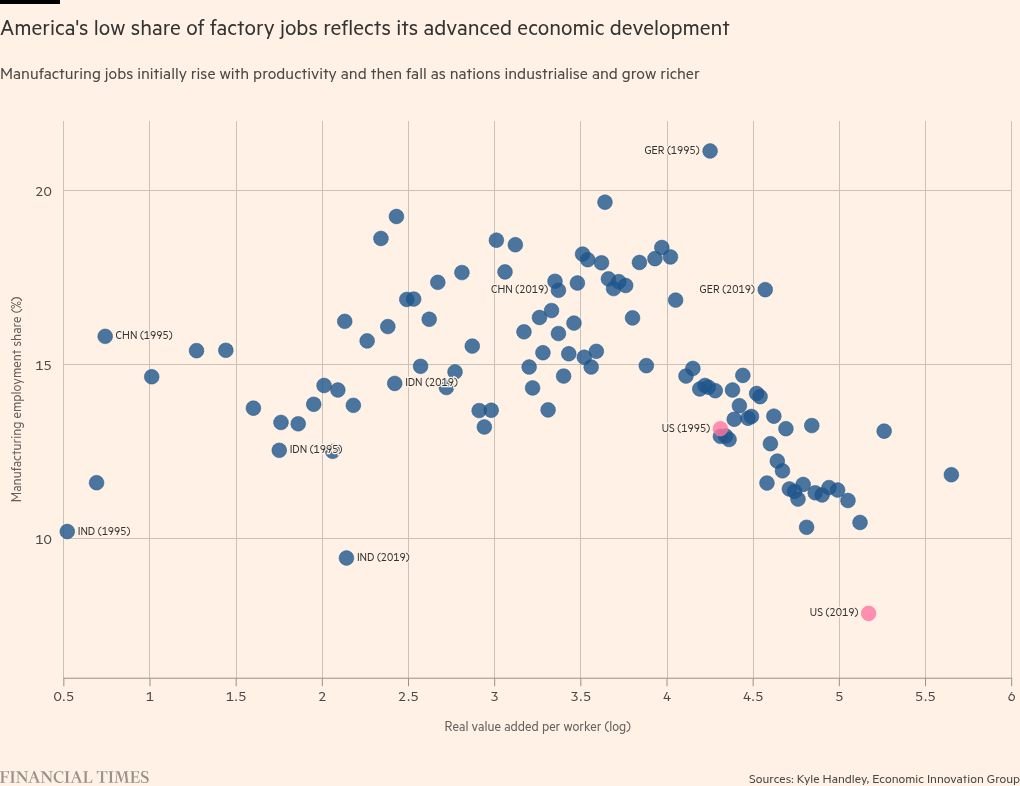

The American manufacturing output has already increased over the past four decades, even as the factory functions have declined. The American industry is more productive today. It makes products of higher value with higher wages with fewer workers (and more robots).

In fact, the added value of each worker is measured by American manufacturing ranked first among major economies (estimated at nearly seven times China China). More than five of the United States manufactured exports are highly research and developing products, such as advanced technology and space products.

The United States is ranked second behind China only in its share total Global manufacturing output. In most measures, America actually “Ultra -manufacturing power. ”

I have given the lead in part by using external sources in low -wage jobs and converting to economic activities of higher value: services, research, development and advanced manufacturing. This allowed smokes, jobs and economics to grow.

“Americans are now designing products and engineers such as tennis and iPhone elsewhere,” said Colin Jarabo, assistant director at the Kato Institute. “They may not be relieved in factories, or even work for companies that own factories, but they are, they are vital grassrooms in production lines.”

Since 1990, America has lost more than 5 million manufacturing functions. At that time, it gained 11.8 million roles in professional and commercial services, 3.3 million in transportation and logistical activities, linked to multinational supply chains.

However, if the purpose of the tariff wall is to force dense parts in the supply chain to move on the beach, it will come at the expense of these higher value activities. American companies will need to transfer resources towards them, which means expanding the scope of services and research and development. (As we mentioned, foreign capital is unlikely to be coming and that the labor offer is limited.)

This also means accepting higher costs. Given a lower range, higher wages (relative to developing economies) and “transition costs”, the Trump plan will raise consumer prices for low -income families that are currently getting cheap commodities across international markets. Until the local supply chains are created, the high import costs thanks to the tariffs will have the same effect.

A large part of the demand for any new production of physical goods must come from the outside. The high prices of the portal and reprisals by American commercial partners will hinder this. Americans spend more than their income on services (health, services and entertainment). Many goods have also become “inappropriate” in the digital world (such as DVD tablets, maps).

For evaluation, the research conducted by the Tax Corporation highlights how the tariff of the 232th section of Trump has sparked steel and aluminum imports during its first term production costs for manufacturers (reducing employment in those industries), which led to the increase in consumer prices and exports. The Peterson International Economy Institute estimated that the cost of “providing” one job in steel -producing industries was about $ 650,000. Imagine this through Trump’s tariff.

If the creation of the work of a dense labor factory will be difficult and unwanted and is difficult to achieve using customs tariffs, what is the alternative? Should the previous industrial parts of America accept a decrease in relative income?

“What we have learned is that the adjustments to the big negative shocks to the manufacture of employment-including the great recession, automation and competition-are very slow and have long-term long consequences for societies,” said Kyle Handley, Associate Professor of Economics at the University of California, San Diego.

This means supporting people and companies to adapt faster instead of protecting jobs. This includes reducing the planning rules for support for renewal, stimulating more financial markets towards investments in the real economy, and supporting re -training initiatives to help people raise the level of strong policy of competition. (Definitions add barriers to entering and make it difficult for smaller companies.)

Globalization has become a scale of redemption suitable for shortcomings in local policy in these areas. Its reform will also stimulate more foreign investment and create job opportunities in the United States from protectionism.

Building economic flexibility and movement of movement-to enable post-industry societies to respond and benefit more than the international trade forces-is not easy. It does not work with commercial partners to deal constructively with conflicts. But perseverance, at least maintain the effects of growth of global supply chains.

Trump’s plan instead amounts to America’s return to several decades. If this is what his supporters want, they must be satisfied with making the nation as a whole poorer.

Send rejection and your ideas to freeelunch@ft.com or on x @tejparikh90.

Food to think

How many “Einstein lost” and “Missing Mary Corses”, and what can be done towards them? This International Monetary Fund Blog highlights how talented children finishing innovative backgrounds to what is much lower than their potential.

Recommended newsletters for you

Trade secrets The variable face of international trade and globalization must be read. Subscribe here

unfamiliar – Robert Armstrong dissects the most important market trends and discusses how to respond to the best Wall Street minds. Subscribe here

2025-04-13 11:00:00