Nvidia becomes world’s first $5tn company

Open Editor’s Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

Nvidia has become the world’s first company to be valued at $5 trillion after shares of the US chip giant were boosted by strong sales of its artificial intelligence systems and the prospect of expanding access to the Chinese market.

Shares of the Silicon Valley-based company, which has been the biggest beneficiary of the artificial intelligence investment boom, rose 3.5 percent in early trading on Wall Street on Wednesday, pushing its market value to $5.05 trillion.

US President Donald Trump said on Wednesday that he intends to discuss Nvidia’s Blackwell chip with Chinese President Xi Jinping when the two leaders meet later this week, raising the possibility that Nvidia will regain access to a lucrative market for its semiconductors.

Nvidia’s latest generation GPUs are currently unavailable in China due to US export controls.

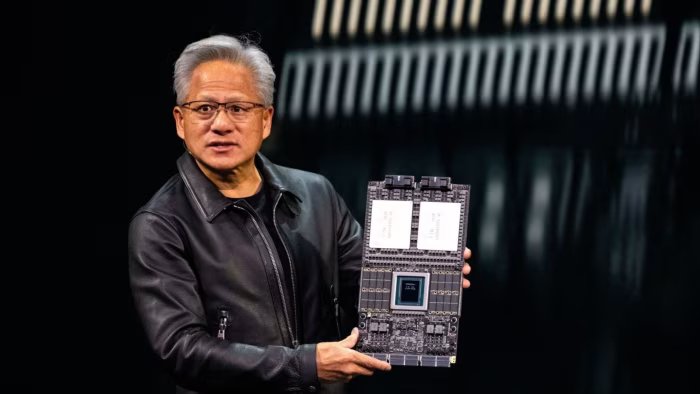

The chipmaker’s shares rose 5 percent on Tuesday, adding more than $200 billion to its market value, after CEO Jensen Huang said Nvidia has already secured half a trillion dollars worth of orders for its artificial intelligence chips for the next five quarters.

The milestone for the stock comes just three months after Nvidia became the first public company to reach a market value of $4 trillion, and with shares in other US technology groups also rising to record levels in recent months.

Apple reached a $4 trillion valuation for the first time on Tuesday, while Microsoft reached the benchmark again after previously reaching it in July, driven by the restructuring of OpenAI, in which it holds a 27 percent stake.

Three years ago, before OpenAI’s ChatGPT came along, Nvidia was worth about $400 billion. Its shares have grown tremendously since then, fueled by demand for its AI chip technology, which dominates the market for training and running large language models like OpenAI.

The AI chip maker’s market capitalization surpassed $1 trillion within months of ChatGPT’s launch, reaching $2 trillion in February 2024 and $3 trillion in June last year.

Nvidia shares have risen more than 85 percent in the past six months alone, and the company is now worth more than the major stock indexes of Germany, France and Italy combined.

Confidence in Nvidia’s ability to sustain its growth has been bolstered by a barrage of multibillion-dollar long-term deals around the world this year to build massive data center infrastructure to train and run artificial intelligence models.

“I think we may be the first technology company in history to achieve half a trillion dollars in revenue,” Huang said on Tuesday, referring to orders for the current generation of chips and new models scheduled to launch next year.

Bernstein analysts said Hwang’s forecast meant Nvidia was on track to achieve more than $300 billion in chip sales in calendar year 2026, compared to Wall Street’s forecast of $258 billion.

The chipmaker’s growth has been driven by massive spending by a small group of large technology companies seeking to build the infrastructure to run artificial intelligence models.

But Nvidia’s competitors, including its own customers, are looking to grab a bigger share of the hardware market.

Nvidia has also moved to pump billions of dollars into its customers, including a planned $100 billion investment in OpenAI announced in September, raising questions about circular financing arrangements used by companies leading the AI boom.

Capital spending by the six largest cloud computing companies alone — Amazon, Meta, Google, Microsoft, Oracle and Corewave — will rise to $632 billion by 2027, Hwang said.

Nvidia’s growth has come despite tensions between Washington and Beijing this year that have stifled its access to China, costing the chipmaker billions of dollars in revenue on its China-specific AI chips that were designed to comply with U.S. export controls.

Beijing, in turn, has launched a backlash against Nvidia chips as it seeks to separate itself from American chip technology.

On Tuesday, Huang admitted that Nvidia is blocked from entering China’s AI chip market for now and will need to “wait until… [China] He wants us to be there.”

“Do they want to be an open market or a selectively open market?” Huang asked. “That’s a question they have to answer.”

Nvidia is also waiting for a 15 percent revenue-sharing agreement with the US government, reached earlier this year to allow it to continue exporting its chips to China, to be codified into law.

Huang has established a close relationship with Trump, as he confirmed this week that he contributed to the White House ballroom project created by the US President, which costs about $300 million.

2025-10-29 13:30:00