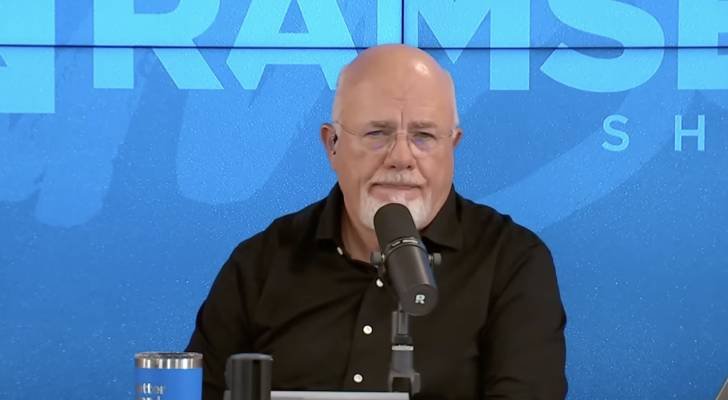

NY woman loans boyfriend $200K — then he lost it all in crypto and broke up with her. But Dave Ramsey has a plan for her

Imagine your entire life, and to save hard, just see your partner blowing $ 200,000 of your money on the encryption scheme. This is exactly what happened in the benefit of one of the calles in New York Ramsey showWho is now celibate and leaves only $ 95,000 for her name.

Lisa question: What now?

In 55 years, she now works as a servant in a sophisticated restaurant and tries to know how to rebuild its financial future. Her biggest fear? She will not have enough to retire.

Lisa Dave told her that she gave her (now previously) her boyfriend for money because she thought she was for a long time. They were together for seven years, and while they never married, I thought the relationship would continue.

Instead, she ended the relationship after she lost most of her life savings. He is now doing small monthly payments, but she said that this often covers interest, and she is not sure whether she will never return the manager.

Lisa said, “I will leave her in the hands of God if you prepare money,” Lisa said.

While Dave Ramsey admitted the painful extent of the situation, he quickly found a silver lining.

He said, “Let’s just demonstrate anything of that.” “If you call and say,” I am 55 years old and I have $ 95,000, I will say, “Yes, you will be fine.”

However, being fine comes with circumstances. Ramsey explained that Lisa’s savings alone will not transfer it through retirement. You will need to continue working, avoid debts and invest wisely. The key is not only 95,000 dollars, but it has a plan for what it will do.

Ramsey explained a step -by -step investment strategy:

-

Emergency Fund allocated: Keep the expenses between three to six months in the high -return savings account. For her, this is about $ 15,000.

-

Invest the rest: Transfer the remaining $ 80,000 to good investment funds in stocks.

-

Use Roth Ira: Contributing every year to take advantage of tax -exempt growth.

-

Look at her workplace 401 (K): Although there is no employer match, Ramzi suggested contributing to some of her income in 401 (K) because IRAS has fewer annual contribution limits.

-

Invest 15 % of its income: With an annual income of about $ 60,000, it should aim to invest about $ 9,000 a year with their retirement accounts.

2025-07-29 12:30:00