Dots.eco is a platform for real-world environmental rewards in games

Dots.ECO, a platform for environmental rewards in the real world, has emerged as a profitable company that can help gaming companies to develop their fans through a common interest in providing the environment.

Since 2022, the company has made a partnership with more than 40 games with a billion groups, including Scopely, Playtika, Plalarum, Wooga and Miniclip’s Iliyon, and more. An estimated 100 million players participated in Dots.ECO provision activities. This week, Supercell, Zynga and Rovio are operating their integration related to environmental topics.

Through the Real World Rewards program, players can grow trees, protect wildlife, clean oceans, and more, only by accessing landmarks, buying game elements, making websites purchases, or completing games tasks. Nadaf Grosz, CEO of Dots.ECO, said in an interview with Gamesbeat, that the game becomes a channel to do good.

Dots.ECO is a partner in the Play for the Planet Alliance, an initiative facing the United Nations Environment Program (UNEP). Today, the program begins today with the participation of 57 studio in the annual green game jam with the official history of Go-Live.

“We thought: What if every game could have an effect in this way?” Grosss said. “When our pilot with a fun house in Playtika showed extraordinary results in the record, we knew this should become a platform.”

Hay Day is the title of agriculture supercell that enables players to protect nature. For Green Game Jam 2025, Hay Day illuminates the protection of pollinators through a campaign that supports memorization organizations via Dots.ECO and maintain the edge, which turns the player’s participation into the results of conservation in the real world.

On the Wooga trip in June, players are rewarded with the motifs inspired by animals and plants as part of the event, while behind the scenes, Dots.ECO enables the real memorization on the ground.

In Social Point’s Dragon City, players can join the Environmental Day pass to help plant real trees through Dots.ECO. They will get a customized certificate that shows its impact in the real world by completing the tasks and canceling the environment day insurance or Dragon Leatherback Dragon.

Assets

Dots.ECO was founded by Grosz University Friends, a technology serial businessman, a long -term environment activist, and Daniel Madrid Spitz, who has a wide background in operations and sales, as a hub from a positive games studio called ethical treatments.

“We started seeing traction with one of our games and we have already thought of providing our staple as the owner of SDK so that other games could use them. I was not sure of the game’s results, and I wanted to consult with my friend Tal Friedman, who was at that time, General Motors at Playtika’s house for fun.” “When he opened our analyzes, the results of our game were very good, and immediately showed a test with House of Fun. The players loved them, and the results were above any expectation. We were shocked, and this is the way Dots.ECO was born.”

With little funding so far, they managed to sign contracts and integrate into some of the largest games and studios in this industry, build deep technology and generate a tremendous impact.

It has been founded with a task to save the planet and involve players in their games, as the work is going well so far. More than 3 million players won the Dots.ECO certificate and have made an impact that contributed to some reason. They planted 1400,00 trees, saved 800,000 sea turtles, protects 7 million acres of wildlife habitats, cleans 400 tons of plastic in the ocean, recovered more than 30,000 coral reefs, and more.

The best campaigns reinforced the performance of the total revenue by 10 %, increased for the first time in paying users by 20 %, and increasing the game by 25 %. Very good for a company with only 13 people and about a million dollars collected so far.

“We were a service that started after I got a play studio. This was called ethical treatments, in which you created sustainable games. I saw the need for a deeper solution, a technical solution, and a reliable solution to add an environmental effect in a tracked, reliable, and transparent toys.

They have reached a wide range of tasks where players could do good, such as planting trees, and realized that there are ways to check that trees were planted through satellite images and AI.

“We get pictures, videos and everything we download to our basic system, analyze everything, check different measurements of progress, and how the project progresses, if it is satisfactory, if it is presented according to the promise or not. And all these projects, we convert them into small quantitative units.” “We call them points. These are points, and use them in games to motivate players to perform procedures, advance in the game levels, put them in applications purchases, remove ads, and more.”

They send certificates and 18 % of the players who get it. This becomes a way to the game Virality of the game, which enhances the popularity of the game and social awareness.

“This helps the game to get visitors to return,” said Grosss. “We have interest and other parameters, and it shows that we can increase the game by 25 % for users who pay for the first time. These activities can fit any game. Our momentum is strong.”

“We believe in a humility that we have the formula here to make a real and shift change, because donation and charity, he is a nice person who feels satisfied with that,” Madrid Sbeitz said, in an interview with the games.

How to work

- The Dots.ECO platform displays an application programming interface for more than 250 global environmental projects that have been constantly examined, including satellite images analysis, images of causes, and reports, which have been analyzed by AI Infose technology.

- Dots.ECO can integrate naturally with many game themes, as it supports a wide range of animal species, habitats and themes in almost every game.

- Games integrate API, Dots.ECO Unity SDK, stimulate the features of the game, or inside the app. For example, you will provide a sea torch, buy 10ft2 from the ground for wildlife, protect Hero Animal, to download the game, reach a certain level, buy the skin or remove ads.

With little funding so far, they managed to sign contracts and integrate into some of the largest games and studios in this industry, build deep technology and generate a tremendous impact.

background

Dots.ECO is a platform for environmental rewards that transform millions of partial procedures into environmental impact on real life. The company can celebrate every individual who takes positive measures for their company, their lives and the planet.

Through integration into games and other applications, the company builds the largest society of impacts in the world and the plural life and is devoted to converting daily procedures into a transformative effect of a sustainable future.

As an accredited company from B-CORP (a company that works for public benefit), the official partners of the United Nations for the restoration of the ecological system, part of the startups from Google for Sustainable Development and a candidate for the Earthshot Award, the company is committed to creating real difference.

Dots.ECO believes that the environmental effect can be closely consistent with business growth, and that it contains a formula for a truly transformational change on this planet. The goal of Dots.ECO for 2025 is to increase its impact by 10 times from 2024 and build the largest society of impact in the world.

“We are incredibly proud of the size of our influence so far, but more than that of the environmental awareness that you adopt in the World Games community. We believe that games can make a transformative change on this planet. We are working on a future where 5 million points are not a prominent sign, it is moderate monthly, weekly or daily.”

Dots.ECO activities extend beyond games, and a partnership has already been held with some of the leading companies there, whether through their loyalty programs, employee or direct integration programs in their products, from the purchase of the media, to insurance, and even electric car rental. One of our main goals is to create the largest community of influence in the world, expose more people to experience sustainable games, and provide more value to our partners.

International Environment Day – June 5

This week, the company and other groups are progressing with environmental activation in the game through many studios and higher types, which have been timid to celebrate World Environment Day. These activations allow players to contribute to the effect of the real world, such as planting trees or protecting wildlife, through regular play.

Participation titles include Angry Birds Dream Blast (Rovio), Dragon City (Social Point), Hay Day (Supercell), Best Fiends (Playtika) and June’s Journey (Wooga). They all started on June 4.

Players will be able to contribute to real world restoration projects by applying through story stories, completing tasks, or making purchases, all of which are smoothly integrated into the topic of each game and mechanics.

“It was very pleasure to cooperate with Dots.eco for the Wildlife Week holders in June. We were aiming to make this campaign more prominent and exciting for our players compared to previous years, and Dots.ECO provided great support to achieve this goal,” said Galina Viulova, Director of Product Marketing at Woga.

This is not only good for the planet – it’s good to work. The previous campaigns that use Dots.ECO reinforced the revenue platform by more than 10 %, increased my first time by 20 %, and the session’s time increased by 25 %, all with the highest degrees of feelings that some studios have seen

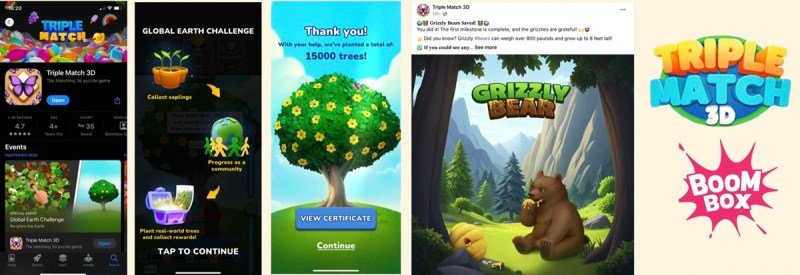

“We have made a partnership with Dots.ECO for our societal event at Earth Week at True Match 3D. This cooperation has achieved great success, greatly strengthening the main performance indicators in our game and positively influencing our social channels. We are excited to work with Dots.eco again to create more important environmental initiatives,” Uri Nabaro, head of the producer and game in a statement.

Why games are a good match

“We need to harness a train that walks very quickly. We can either try to replace it from the bars, or to give up everything, stop everything, jump on the train and try to harness it,” Grosss said. ))

He said that for games, it is an ideal match, because the multi -use industry and the players of the players know that they can change the world.

The company realizes that many people of the population are skeptical of climate change.

But he said: “People love nature. It doesn’t matter if you are Republican, if you are democratic. You love nature. You may not agree to something, but you love your nature. You love the animals around you.”

Don’t miss more hot News like this! Click here to discover the latest in Technology news!

2025-06-05 13:45:00