Online criminals attacking HSBC ‘all the time’, says head of UK arm

The head of the UK arm at HSBC said the bank “is being attacked all the time” by online criminals, with cybersecurity now its largest expense, and the lender costs hundreds of millions of pounds.

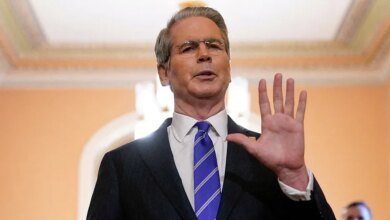

Ian Stewart sought to reassure deputies that cybersecurity was “at the highest of our mastery a lot”, amid increasing concerns that other large companies could fall victim to the type of attacks that caused chaos among retailers such as Marx & Spencer and cooperation.

M & S has been struggling for nearly a month since targeting its information technology systems during the weekend, as the attack struck its online operations and left some of the travelers empty.

Related to: Google says that “aggressive” infiltrators are now targeting their American stores.

“This worries me … we have been attacked all the time, and therefore the defense mechanisms in which you put it are very important,” said Stewart. He said this involves “investing hundreds of millions of pounds.” “This is our biggest expenses at work.”

“The amount of money [that] Banks, all of us, will spend on our enormous systems today – and it must be. It should be because our customers depend on digital technology all the time. “

The need to maintain the bank’s systems smoothly – 24 hours a day, seven days a week – since the presidents began to increase the pace of branches and push more customers to the use of digital applications and banking services via the Internet.

Stewart said that at the group level, HSBC alone treated 1000 paid per second. Meanwhile, the bank was making about 8,000 changes to its information technology systems every week. He said that no bank will be able to ensure that its services could remain on the Internet all the time. “So the skill, how quickly recovery?”

Information technology systems in banks have been exposed to increased audit in recent months, as customers have suffered in the largest banks in Britain and building societies from the equivalent of more than a month of information technology failures between January 2023 and February 2025.

These numbers did not include the full effect of interruption in Barclays, which started at the end of January and was affected by 56 % of online payments during the decisive payment period for many employees. There has been more disturbance in Barclays since then.

Speaking to MPS on Tuesday, the CEO of Barclays operations in the United Kingdom, VIM Maru, said that the problems were caused by the software conducted by an external company.

“The problem of the program was the root cause, and we worked with an provider of an external authority that provides us with this program. We learned lessons about it. We have put a reform in its place means that we will not have a repetition. After that we look forward, there is another reinforcement that we do, and it is in the middle of implementation.”

Barclays president again apologized to the affected clients. He said: “We regret the disruption that our technical problem caused on January 31 to our customers. We have worked very hard to recover from that and make sure we put the right steps in their place.”

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-05-20 15:13:00