Rachel Reeves squeezed by rising borrowing costs and spending pressures

The sale of the global bond market raised by US debt concerns has led to new pressure on UK advisor Rachel Reeves and its self -imposed financial rules.

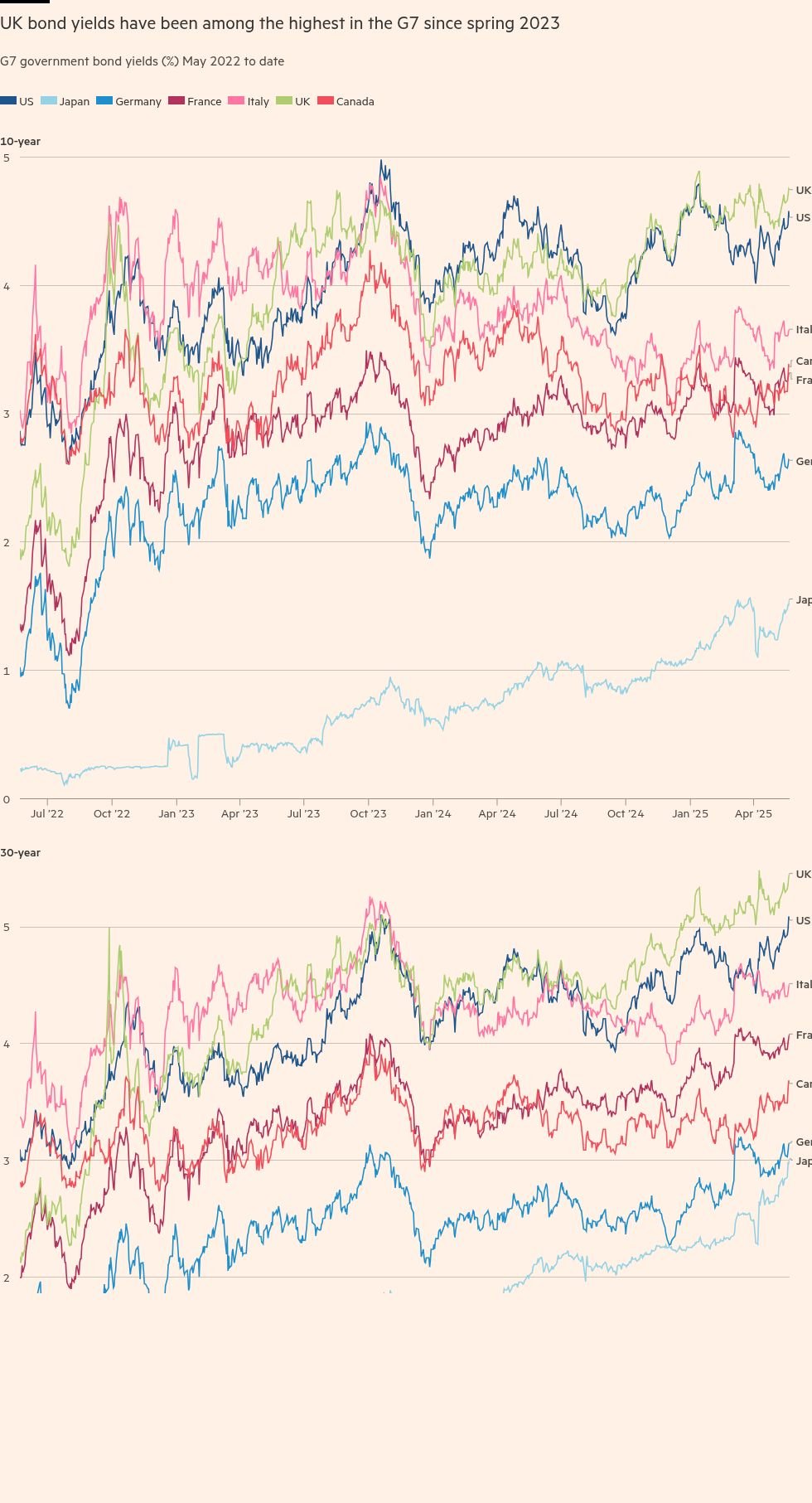

The return on a 30 -year -old sect is approaching the highest level in 27 years and closed by 5.48 percent on Friday, after gains in the revenues of American and Japanese government bonds in recent weeks.

Meanwhile, gilded revenues have increased for 10 years in the UK, and the standard debts that investors have seen more closely, than in any other country of G7, which Japan prohibits during the past year.

As economic growth continues in the UK, investors have warned that Reeves would need to reduce public spending or raise taxes again to meet its rule to achieve a balance between daily spending with revenues by 2029-30.

“Gilts are still in Crosshairs,” said Anders Pearson, head of the global fixed income in the asset manager.

High borrowing costs give up the Refers Financial Chamber of the maneuver just as it also faces fierce political pressure to relax to hold on spending.

Prime Minister Sir Kerr Starmer announced last week plans to reflect at least 1.5 billion pounds from the annual savings allocated from fuel payments in the winter of all retirees except for the poorest retirees.

He also wants to end the child’s entitlement ceiling, at a possible cost of about 3 billion pounds annually. Deputy Prime Minister Angela Rainer has suggested that long walking taxes, especially to fill the financial opening.

Britain, like other countries in Europe, is also forced to increase the defense spending in response to calls from the Trump administration.

Global events have made life more difficult for Reeves this year. US Treasury bonds have been sold in response to Donald Trump’s commercial war fears and the huge tax discounts he paid across congress. A similar rise was seen in Bunds revenue after Germany leaders concluded a historical deal to finance investment in the military structure and infrastructure in the country. Reverse the price.

“The high association with the cabinet and Bunds may have left them vulnerable to the sales that depend on the last finances,” Person said. “But the risks of the United Kingdom are painful.”

Person referred to stubborn inflation in the UK, which is reflected in the position of the Bank of England caution over interest rates and clarifying in a tripartite division between policy makers this month. He said that the division suggested slow price discounts “despite the signs of weak basic growth.”

But some analysts argue that politics is bad steps has weakened the country’s flexibility in the budget, which leaves it completely vulnerable to the bond market turmoil.

This includes Reeves’s decision to run at only 9.9 billion pounds from the Hall of the head against the daily spending base, in addition to the Labor Party pledge that it will not win their main revenues such as value -added tax or income tax.

The bond sales program by Bank of England also adds to the nerves about appetite among adult investors for long -term debts.

“At times of such markets tend to search for extremist values - places where things may get worse – and unfortunately the United Kingdom finds itself in this category,” said Isabelle Matthews Yago, Senior Economist at BNP Paribas.

She said that the “external shock” of the global economy can lead the budget responsibility office, which is the financial financial agency in the United Kingdom, to reduce its expectations and force more budget tightening.

Mateos Y Lago added that the strictness of the financial rules of Reeves “is already destroying the UK’s credibility because they have to harm themselves a lot to meet them.” “It is an unfortunate place for the United Kingdom.”

“The financial rules are not negotiable. We have put them in place to create stability and support investment. We have seen what happens when the financial rules are placed on one side, and we will not endanger the nation’s money,” the Treasury said.

Andrew Godwin, an economist in the United Kingdom in Oxford Economic Consulting, estimated that market movements since March 26 on March 26 have carved a fresh hole of 5 billion pounds in an area of 9.9 billion pounds.

“They were authors of their menstruation by leaving them a little introduction,” he said.

Some investors have said that reducing the rules and reducing pressure for more discounts in spending or tax height will be risky.

“The United Kingdom has already emerged from the financial space,” said Mark Daving, the chief fixed investment official at RBC Bluebay.

He added, “Any attempt to rid or cancel the framework of this working framework is a risk of anger in the market, given the legacy of what happened with Liz Tros,” referring to the Prime Minister’s “mini” budget in September 2022 at the time.

“It appears that they will have to add more financial emphasis in the fall,” added Peder Beck-Friis, Pimco economist.

Another threat of OBR expectations in the United Kingdom stems in the UK, which is widely seen as outside the assessments of other analysts due to a stronger vision of Britain’s productivity.

Any reduction to productivity predictions, which can come once October, would deal with another amazing public finance.

Ruth Gregory, an economist at the Capital Economics Research Company, said that if OBR reduce its expectations for the growth of potential productivity from 1 percent annually between 2025 and 2029 to 0.8 percent per year, “This may reduce the Capital Hall by about 20 billion pounds,” said Ruth Gregory, an economist at the Capital Economics Research Company.

“Reeves took a major bet last October by leaving itself without almost any head hall,” said Paul Johnson, head of the Institute of Financial Studies. “It doesn’t seem to get away with it.”

Imagine data by Keith Fray

2025-05-26 04:00:00