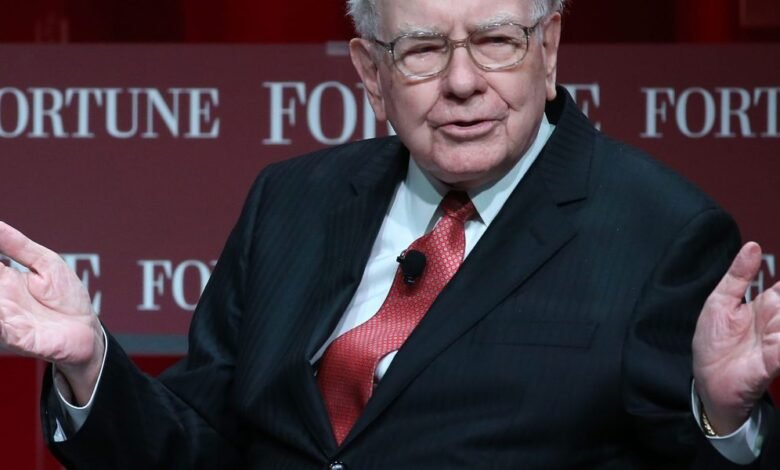

Warren Buffett has long warned others against picking stocks, but admits he invests in a ‘very irregular manner’

- Warren Buffett’s sudden advertisement On Saturday, he plans to step down later this year, as the CEO of Berkshire Hathaway renewed the focus on his legacy and influence. Although he has what follows this pores on the movements of his shares, Buffett has long maintained that ordinary investors should not choose shares and instead only stop their money in the S&P 500 index.

The legendary investor, Warren Buffett, has the following followers who follow his movements closely, but he urged most people to do it, as he says and not as he does.

His sudden announcement renewed on Saturday that he was planning to step down later this year, as the CEO of Berkshire Hathaway renewed the focus on his legacy and its impact on investors.

For many years, Pavite preached your money in the S& P 500 index, instead of trying to overcome the market by choosing individual stocks. In 2007, he made a $ 1 million bet that the index outperformed a group of hedge funds for 10 years – and won.

When it comes to his personal money, he puts his money where his mouth is. In his 2013 message to Berkshire’s shareholders, he gave his simple advice to a guardian of his wealth to his wife upon his death.

“Put 10 % of cash in short-term government bonds and 90 % in the very low-cost S&P 500 index box. (I suggest Vanguard’s.) I think long-term results of this policy will be superior to those who have received most investors-whether pension funds, institutions or individuals-employed high managers.”

The high negative investment popularity in recent years, led by the index funds, indicates that many Americans have already taken advice.

However, Buffett shares movements are closely monitored, and investors in the quarterly Berkshire are transported that reveal what the markets buy and sell, as investors search for possible evidence about what to do with their own money.

Presscience’s Prascience was shown only last month when the shares were destroyed. His sales from Apple shares last year, which added to a huge cashme from Berkshire, now looks especially good given that the sale of the market caused by President Donald Trump’s tariff.

On Saturday morning, before he fell a bomb bomb that he wanted Greg Abel the position of CEO by the end of the year, Buffett implicitly admitted that his investment activity in Berkshire contradicts his advice.

“We have earned a lot of money by unwillingness to invest entirely at all times, and we do not believe that it is already inappropriate for people who are negative investors only to make some simple investments and sit in their lives,” he told the shareholders during a question and answers session at the annual meeting.

“But we made a decision to be at work, so we believe that we can do a little better by acting in a very irregular way,” Buffett added.

Currently, he maintains his drought because he has gathered the prices of high assets for a long time and that there are no deals there to install them. Berkshire said on Saturday that its available money increased to 347.7 billion dollars at the end of the first quarter, up from 334.2 billion dollars at the end of the fourth quarter.

While Buffett also revealed that Berkshire was close to pulling the trigger on a $ 10 billion deal, he continued to refer to patience.

He said that an attempt to invest tens of billions of dollars every year “will be the most stupid in the world” because “things become very attractive at times.”

But he expressed his confidence that the opportunity to invest will come in the coming years. “It is unlikely to happen tomorrow,” said Buffett. “It is not unlikely to happen within five years.”

This story was originally shown on Fortune.com

2025-05-04 19:25:00