Revisiting the Influential 20th-Century Thinker

In 1989, political scientist Francis Fukuyama published an essay in the National Interest arguing that the collapse of the Soviet Union and growing U.S. influence in China might signal the final form of human government—namely, the combination of Western liberal democracy and state capitalism. He called this “the end of history,” a term that has since become a byword for the neoliberal era that may now be nearing its end. But Fukuyama did not coin the term. He got it, via his mentor Allan Bloom, from the Russian French philosopher Alexandre Kojève. Indeed, much of Fukuyama’s essay, as well as the book that followed, was devoted to interpreting Kojève’s thought and life.

It’s not hard to understand why. Though in many ways an academic cult figure, Kojève could lay legitimate claim to the mantle of most influential philosopher of the 20th century. He set the program for much French thought after World War I, including the reading of Hegel, the attempted synthesis of Heidegger and Marx, and a surprising range of social theory, especially of psychoanalytic and postcolonial varieties. Such a legacy would already rank him high in the list of modern thinkers, and yet this only accounts for some of Kojève’s influence. As a civil servant in the postwar French government, he also had a pivotal role in the development of the European Economic Community, the precursor to the European Union.

In 1989, political scientist Francis Fukuyama published an essay in the National Interest arguing that the collapse of the Soviet Union and growing U.S. influence in China might signal the final form of human government—namely, the combination of Western liberal democracy and state capitalism. He called this “the end of history,” a term that has since become a byword for the neoliberal era that may now be nearing its end. But Fukuyama did not coin the term. He got it, via his mentor Allan Bloom, from the Russian French philosopher Alexandre Kojève. Indeed, much of Fukuyama’s essay, as well as the book that followed, was devoted to interpreting Kojève’s thought and life.

It’s not hard to understand why. Though in many ways an academic cult figure, Kojève could lay legitimate claim to the mantle of most influential philosopher of the 20th century. He set the program for much French thought after World War I, including the reading of Hegel, the attempted synthesis of Heidegger and Marx, and a surprising range of social theory, especially of psychoanalytic and postcolonial varieties. Such a legacy would already rank him high in the list of modern thinkers, and yet this only accounts for some of Kojève’s influence. As a civil servant in the postwar French government, he also had a pivotal role in the development of the European Economic Community, the precursor to the European Union.

The Life and Thought of Alexandre Kojève, Marco Filoni, trans. David Broder, Northwestern University Press, 280 pp., $38, July 2025

The question for readers of Kojève has always been the extent to which his practice as a government official can be traced to his philosophical theory. His now-famous debate with the German American political philosopher Leo Strauss was on precisely this point. Strauss, a proponent of “classical political rationalism” and godfather to the neoconservative movement, was highly skeptical of the possibility of a philosophical politics, citing the disastrous results of Plato at Syracuse, when the philosopher went to advise the dictator Dionysus I and ended up being sold into slavery. Kojève, by contrast, was deeply invested in the role philosophical speculation could play in political action.

In Marco Filoni’s The Life and Thought of Alexandre Kojève, recently translated from Italian by David Broder and significantly expanded from its 2008 original, the question of the relationship between Kojève’s philosophy and his politics is cast into fascinating relief by a detailed account of his extraordinary life. From the Russian Revolution to the early days of the Cold War, Kojève always seemed to position himself at the heart of the action. That he lived through moments of great uncertainty, thought deeply through their contradictions, and then contributed in a real way to the establishment of a new international order, might give some hope—whatever your opinion of his conclusions—to those trying to think through the turmoil facing much of the globe today.

A view of the Red Square in Moscow in the early 1900s.HUM Images/Universal Images Group via Getty Images

Born in 1902 to wealthy Moscow industrialists, Kojève was keenly aware of the world-historical tumult of his time from a young age. Following the death of his father in the Russo-Japanese War in 1904, Kojève’s mother married a prominent jeweler, who was killed during the 1917 revolution while attempting to defend his countryside property from a break-in by, Filoni suggests, marauding peasants emboldened by the uprisings in Moscow and Petersburg. Despite this, the young Kojève was thrilled by the revolution, not least because its leaders were accomplished theorists. Even after he was arrested for selling black market soap—an obviously unreconstructed capitalist, he was saved from execution because his uncle had become Vladimir Lenin’s personal physician—it was only the new Soviet policy banning former bourgeoisie from higher education that finally convinced him to leave Russia, never to return.

After a highly eventful flight through Eastern Europe, which involved hiding out in a cabin in Poland while his friend and companion-in-exile snuck back into Moscow to retrieve the jewels left by his murdered stepfather, Kojève settled in the philosophical hotbed of Heidelberg, Germany, where he would receive his Ph.D. for a dissertation on the Russian theologian Vladimir Solovyov.

At the age of 24, Kojève made his way to Paris, where he established himself in short order among the intellectuals of the day. A very abbreviated list of attendees to his famous 1930s lecture series on Hegel’s Phenomenology of Spirit in Paris included Jacques Lacan, Georges Bataille, Hannah Arendt. Despite criticism that Kojève presents a limited, even garbled vision of the great German philosopher’s thought, it was Kojève’s Hegel that became the reading that many still consider standard today.

Kojève never lost his admiration for the Russian Revolution, nor for its leaders. As an adult in Paris anxiously observing the Nazi occupation of the French capital, Kojève wrote a letter to Stalin himself, now lost, which he asked the Soviet embassy to deliver. Whether Stalin ever received this letter is unknown; it is likelier, Filoni suggests, that embassy officials burnt it before the German army could confiscate their archives—a lucky break for Kojève, as its recovery by the Nazis would surely have meant his arrest. This notorious letter, along with some post-glasnost suggestions that Kojève had been a KGB spy, has been fuel for rightwing conspiracy theories about the EU’s communist origins, though Kojève didn’t exactly make such speculation difficult, fraternizing as he did with known Kremlin operatives and referring to himself often, perhaps jokingly, as a Stalinist.

To be sure, it couldn’t have been entirely a joke. Kojève’s interpretation of Hegel allowed him to view the Soviet project, up to and including events like the Great Terror in the 1930s, as simply the outworking of the rational principles of history. Following both Hegel and Marx, Kojève was preoccupied by how society formed itself not around fixed ideals, but through the contradictions and conflict that arise between mutually exclusive values. In Kojève’s reading, society must pass through extreme violence to reach the inevitable end-result of historical development.

If the question that arises from this is how this Stalinist partisan became a policy wonk setting the terms for a state-capitalist federation such as the EU, Filoni’s exploration of Kojève’s wartime activity and postwar writing paints a far more complex, even murky portrait of the politically engaged philosopher. Kojève undoubtedly participated in some aspects of the French Resistance: He was briefly arrested after attempting to convince some German soldiers to desert and, with the enviable negotiation skills that would serve him well decades later, managed to talk himself out of being shot. He may even have participated in the liberation of a village. Yet he also spent some of the war writing theoretical texts that would provide the foundations for a more coherent Vichy regime.

In the postwar period, Kojève openly scorned the valorization of the French Resistance, especially engagé writers such as Jean-Paul Sartre and Albert Camus, whose strongly moral—as opposed to simply political—stance during the war struck him as both naive and self-serving. He also advocated the rehabilitation of former vichysois thinkers and officials, writing, “But it would be unfair and dangerous to seek to do without all those who had faith in the ‘Révolution nationale’ and acted accordingly.”

Such pragmatism, if that’s what it is, served Kojève well in his postwar career. He held increasingly prominent advisory positions in the Ministry for Europe and Foreign Affairs, a setting that took on a kind of glamour as young philosophers and economic ministers alike made pilgrimages to pay homage to the éminence grise. He was also an extremely skilled negotiator and alliance-builder, leveraging friendships and professional connections both to establish himself at the center of economic policymaking and to further his own ambitious political program of bending the rebuilding of Europe and the Western world toward a universal state.

In Filoni’s view, the key to understanding Kojève’s multiplicity—some might say duplicity—is the central role irony plays in his life and thought. He had a curious sense of humor that relied on never letting you know whether he was kidding, and he incorporated this mutability into his philosophical method. For Kojève, in a reversal some might find unconvincing, it is the principled stand that reflects a compromised ethics, because it prevents one from remaining responsive to changing situations. This helps to explain Kojève’s apparently flexible opinion regarding Vichy; it may not just have been bet-hedging that kept the philosopher open to at least the idea of some kind of collaboration. His politics, which he would pursue in the postwar settlement, brought together the vanquished as well as the victorious, albeit in a new, synthetic form: “Such a politics,” Filoni writes, “would pass not only through the Resistance, but also through the Vichy regime itself.”

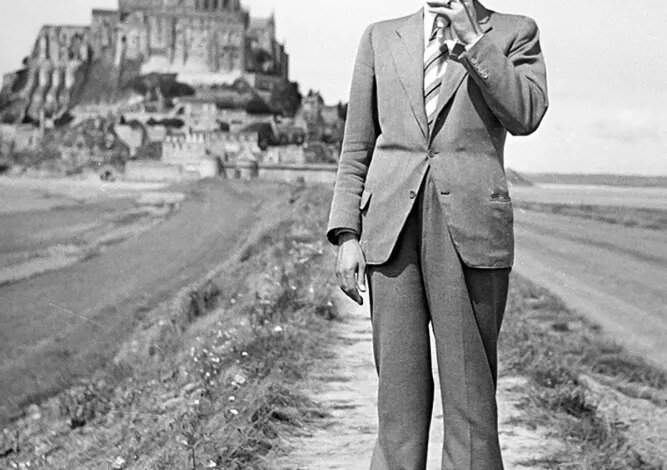

Kojève poses with an owl, date unknown.National Library of France

It may have been the amorphous center to Kojève’s thought that allowed such a variety of philosophers, many of them deeply committed political thinkers, to glean so much from his work. A notable example is Frantz Fanon, the Martinican political theorist who saw in Kojève’s reading of the master-slave dialectic the conceptual blueprint for postcolonial revolution and cultural self-assertion.

At the time Fanon was active, Kojève himself was not only thinking about the postcolonial situation but playing an active role in its unfolding. In addition to his participation in the negotiations for both the Havana Charter and the Treaty of Rome and the development of subsequent tariff structures, Kojève’s primary preoccupation was with how Europe would engage with its former colonies. Operating according to the principle of what he called “giving colonialism,” Kojève envisioned an evolving international order that would one day coalesce into a global society, internally diverse yet unified administratively and, in a sense, spiritually. So far, so technocratic, yet it was this global society that would, for Kojève, usher in the end of history, the final outworking of the rational structures of society.

Though the recent vogue for rehabilitating strange and recalcitrant thinkers means anything is possible, it’s hard to imagine anyone taking the specifics of Kojève’s thought on board today, even as he influenced so much of our modern world—he is at once too specific and too vague, too radical and too demure, too much, above all, himself. And yet it’s hard not to wonder what he would have made of any number of our current peccadillos, dilemmas, and crises.

Obviously, he would have had thoughts on the Russian invasion of Ukraine and the current rearmament of Europe, but he would also likely have been a keen observer of our endless debates on, say, gender politics; no less a thinker than Judith Butler wrote their first book, Subjects of Desire, on the French reception of Hegel, at the center of which was Kojève’s lectures of the 1930s. But to say that he would have thoughts on the subject is in no way to suggest that we can guess what they would be. It’s a dizzying irony of modern intellectual history that comes through clearly by the end of Filoni’s biography: No matter where one turns, there Kojève will be, just out of reach.

Don’t miss more hot News like this! Click here to discover the latest in Politics news!

2025-10-17 18:00:00