All the Questions We Still Have After ‘Tron: Ares’

Tron: Ares It ends with two big questions about what could come next for the network and beyond. Unfortunately, the biggest of these questions after opening weekend is whether any of them will be answered. The film had a lukewarm opening, failing to surpass its 2010 predecessor, Meaning World You see He may be officially dead. However, it took nearly three decades for the second You see To go out and nearly two more for the third. Over the years, the series has shown an amazing ability to reboot, so let’s do it too.

Here are 12 questions and some attempts to answer them after seeing it Tron: Ares. Major spoilers follow.

What does Ares want from Quorra?

Tron: Ares It ends with Ares (Jared Leto), now able to exist permanently in the real world, searching for an Iso named Quorra (Olivia Wilde), and the digital being Sam Flynn (Garrett Hedlund) transported from the network at the end of TRON: Legacy. The desire of Ares, created by Dillinger Corp., to find Quorra, which was naturally created in the network, makes sense. He sure has a lot of questions that you could probably answer. But what does he think will happen next? Is there a method to his madness? And also…

What were Sam and Cora doing?

while TRON: Legacy It ended with some big questions about what it means for a digital being to now exist in the real world, Tron: Ares It largely pushes those events to the side. We learn that Sam Flynn took over Encom for a while before leaving for personal reasons. We see that there have been at least discussions or rumors about Quorra in the press. But what did they do in the fifteen years that followed this film? What did Sam do at Encom while he was there? We don’t know.

Why did Sam Flynn leave Incom?

One offshoot of the final question is the specific nature of Sam leaving Encom. Did he have a new project planned with Quorra? Did he reconnect with a digital version of his father? You almost get the feeling that whatever story happens with Sam and Quorra off screen is just, sort of, whatever that original version of… Tron 3, Tron: AscensionMaybe it was. Speaking of…

He could you can see 4 Use elements TRON: Ascension?

Last week we spoke to Tron: Ares Writer Jesse Wiguto, who has also worked extensively TRON: Ascension before being put on the shelf. since TRON: Ascension Focused on Sam and Quorra’s journey and it was supposedly a very good script after years of development, we asked about it. “That’s a great question,” he said. “I don’t know that I ever thought about it that way, other than the fact that it was Ascension…. I don’t know, is the answer. We’ll find out if there’s an opportunity or conversation about doing another one of these at some point. It’s kind of above my pay grade. But I think it’s an interesting idea anyway, that Ares and Korra will probably find each other.

What’s going on with Julian Dillinger?

To avoid prosecution and almost certainly prison time, eventually Tron: Ares, Julian Dillinger sends himself into the net. There, we see him starting to sort of become Sark, the digital double of his grandfather, Ed Dillinger Sr., from the original film. How does that happen? Why does this happen? If Julian turns into SAARC and works to take control of the Dillinger network, what kind of damage will he cause? We, of course, can’t answer any of these questions, but it’s fun to think about.

Where the hell is Tron?

One main character is not part of it Tron: Ares He is Tron himself, the original hero program from the first film. We asked Wigutu about his absence from the film. “I think there was a conversation at some point [about bringing him back]”At a certain point in development, she just wanted to make this her own,” Wiguto said. And it wasn’t that there was an option to say, “We don’t need Tron.” There was no clear role in this story. And to give the shoe some character, I don’t know, as if it wasn’t necessary.”

Then why is it called? You see?

basic. Most people know You see As a movie, not as a character in that movie or a game that exists in the world of the movie. You have to call it that to recognize the name.

Is Athens really gone?

Athena, played by Jodie Turner-Smith, is clearly one of the best parts of the film Tron: Ares. But when Encom hacks into Dillinger’s network and destroys her while she’s still in the real world, it seems as if she has nowhere to go and actually die. Was it really possible to delete it permanently? It is definitely possible. But, with the law of Permanence now in place, you have to think she might find a way to get revenge on Ares at some point.

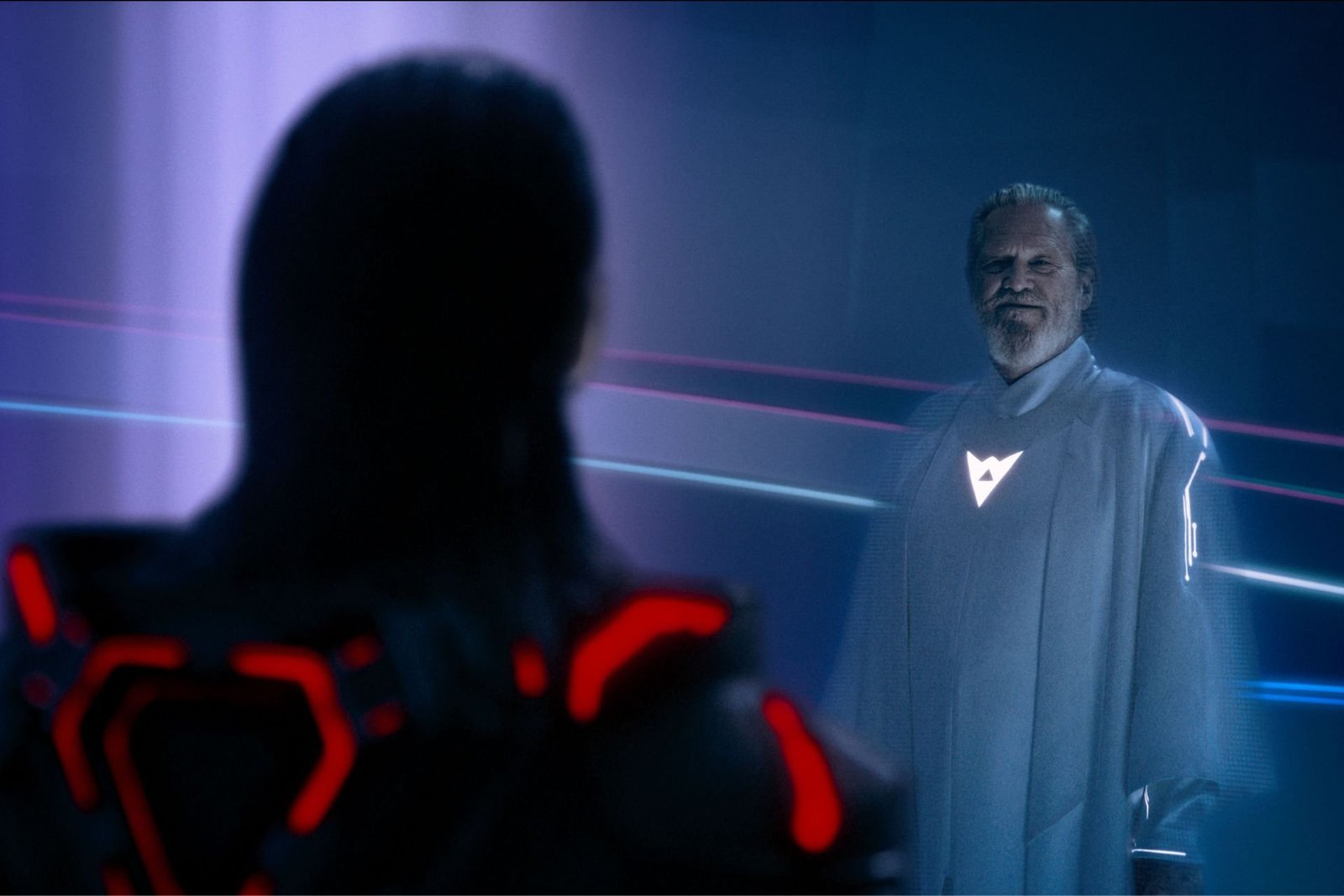

What exactly is this version of Kevin Flynn?

To obtain the Fortitude Token, Ares goes to an old version of the network from the original movie. There he meets Kevin Flynn. But not just any Kevin Flynn. I present Kevin Flynn. This Flynn explains that you can’t jump between networks without entering the real world, so has this Flynn been here since the 80s? Does he have any knowledge about Chloe and Sam and everything in it legacy? We’re not sure, and frankly, we’re a little angry that he left it so vague.

What exactly is Ares?

If you are a computer program given a code that allows you to exist in the real world, who exactly are you? Do you have human organs? Are you just wires? We asked Wiguto what Ares thinks now that he’s out in the real world. “I think there is this kind of undisclosed, potentially very valuable natural resource that is fueling these lasers,” he said. “And there’s something about the kind of genetic link that can’t survive beyond the time limit we put on it, that makes the law of permanence binding. So, in a way, if you split it in half and do a diagnosis or an autopsy, yeah, I’d like to believe you’ll find human biology. But I don’t know that that’s the right answer.”

Do endings legacy and Ares Similar on purpose?

So in the end, our hero took the digital being off the grid to live as a human in the real world. It’s an end TRON: Legacy Besides Tron: Ares. Was this done on purpose? “It’s part of the kind of genetic mapping of the franchise,” Wijoto said. “I love the kind of ellipses that the film leaves itself with. [Ares] there. He’s learning. It’s growing. It’s evolving. Who knows where we might find him next, what he looks like, and what he grew up with? Therefore, this was not done on purpose; It made sense.

Where is Cillian Murphy in all this?

Maybe I forgot, but in tron: legacy, The Dillinger family was portrayed by Ed Dillinger Jr., played by eventual Academy Award winner Cillian Murphy. Ed Jr. was He is the son of the villain character from the first film and was planned to have a larger role if a sequel closer to the previous film occurred. Murphy was getting a little too old by then Ares He was released so he’s not here. But Julian Dillinger is Ed Sr.’s grandson. So, either he’s Ed Jr.’s son, or Ed Jr. is his uncle. We don’t know. But we can safely assume that it is there.

What other questions do you have about Tron: Ares? Let us know below.

Want more io9 news? Find out when the latest Marvel, Star Wars, and Star Trek releases are expected, what’s next for the DC Universe in film and TV, and everything you need to know about the future of Doctor Who.

Don’t miss more hot News like this! Click here to discover the latest in Technology news!

2025-10-13 21:00:00