Trump tariffs lead to wild week on Wall Street

Blackrock CEO and CEO Larry Fink gives tariff negotiations with China and market fluctuations on Campan.

The US financial markets have concluded one of the most volatile weeks since the Covid-19 pandemic, where president Donald Trump is playing quickly and angry with the tariff plan that prompted revenge on China.

When dust settled, all three standards recorded the gains on Friday, which added to the weekly progress.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| Me: DJ | Dow Jones Mediterranean | 40212.71 | +619.05 |

+1.56 % |

| SP500 | S & P 500 | 5363.36 | +95.31 |

+1.81 % |

| Me: Companies | Nasdak | 16724.45559 | +337.14 |

+2.06 % |

Dow Jones Industrial MEVERICE gained 5 % for the week, S&P 500 approximately 6 % and Nasdaq Composite 7 %.

However, the three main indexes remain negative for this year.

Size and fluctuation

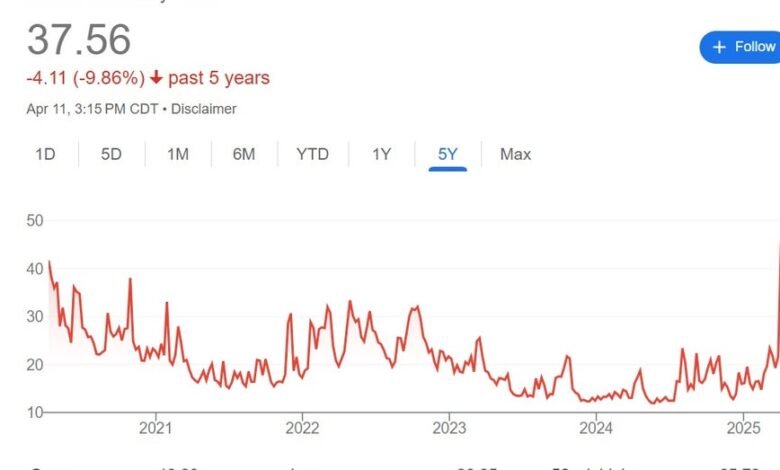

The final numbers did not come without the nail stability. The CBOE fluctuations index, also known as the Wall Street fear scale, reached the highest level in five years as Dow witnessed fluctuations of more than 2000 points during several sessions.

CBOE fluctuation index (As a compliment: Google)

Amid stock sales, you do not panic, as experts say

DOW got 2,692 points on Wednesday, which is the largest rise in one day in history. The total trading volume of this day is $ 30 trillion, and it is the highest in May 2019, as followed by Dow Jones Market Data Group. This is the same day that Trump stopped, in a sudden axis, on some countries.

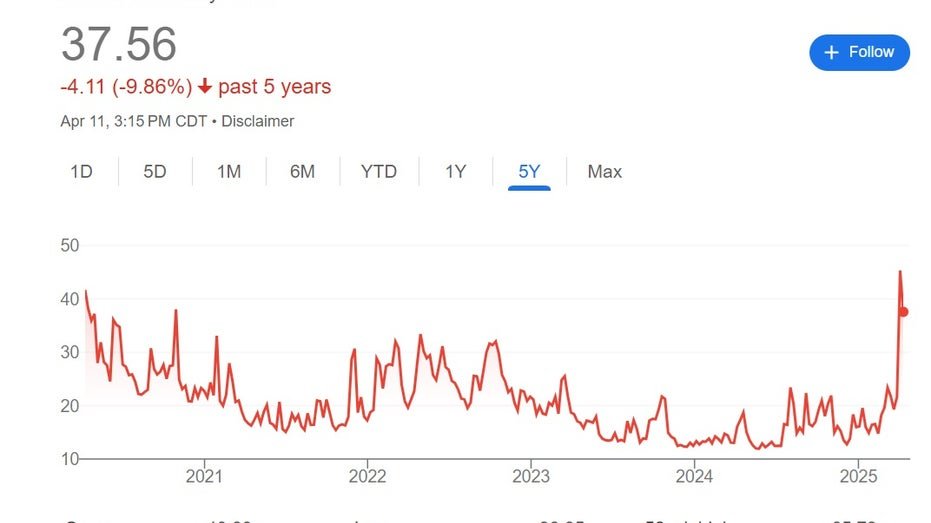

Dow Jon’s industrial average

.

Larry Fink, CEO of Blackrock, referred to the market flexibility at a phone conference with investors on Friday, and said he was still optimistic about capital markets.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| BLK | Blackrock Inc. | 878.78 | +20.00 |

+2.33 % |

“We do not see systematic risks, there is no pandemic,” Fink said. “The financial system appears safe and sound, flexible. The markets are trading more, and more than any other time. With all this volatility, the markets have proven to be very successful and work very well.” It is clear that there is uncertainty in the short term. “

Provides customs tariffs

While the uncertainty about the definitions tested in the investor’s intention, the White House insists that the American commercial representative, Jamieson Greer.

“I have confirmed that more than 15 shows are already on the table, which is just in just a matter. As I said earlier, we heard from more than 75 countries around the world,” said the White House press secretary at the White House on Friday.

President Donald Trump holds a scheme as he presents notes on mutual tariffs during an event in the garden of roses entitled “Make America Wealthy again” at the White House in Washington, DC, on April 2, 2025. (Brendan Smialowski/AFP via Getty Images))

Bond market: Treasury return for 10 years 4.5 %

government bonds flash a more worrying signal as investors pull money due to the recession fears on the horizon. When the returns rise, the prices decrease. The 10 -year treasury, which is the criterion for borrowing costs such as mortgages and personal loans, reached 4.5 %, the highest level since February. The weekly jump, more than 50 years old, was the largest in more than 40 years.

Treasury Secretary Scott Payet was asked about this trend on Wednesday.

“There are some senior translators who suffer from losses that have to benefit from influence,” said Maria Barteromo during an interview with “Al -Sabah with Maria”. “I think there is nothing systematic about this. I think it is uncomfortable but normal in the bond market.”

Executive managers of adult banks on the Trump tariff: “Great Disorder”

Bessent was also asked about the weakness of the US dollar and Chinese procedures.

“They were already weakening their currency, and it is a loser to everyone. Once again, when I hear all these stories that the dollar is no longer the currency of the reserve, if you end up with the Chinese who want to use their currency as a commercial tool, this does not seem like a very good backup.”

Euro Walnin Japanese rose 8 % against Greenback.

US stagnation?

A handful of Wall Street companies requires the risk of the American recession. Jimmy Damon, CEO of JPMorgan Chase, shared his view this week.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| Jpm | Jpmorgan Chase & Co. | 236.13 | +9.39 |

+4.14 % |

“I hear it from everyone now. Damon said on Wednesday in an exclusive interview about” Morning with Maria. “

His company has increased recession to 60 %, while Goldman Sachs now sees a 45 % chance for one of America.

Consumer concerns

On Friday, consumer polls at Michigan University stated that she Consumer feelings The index fell to 50.8 this month from 57 in April, the fourth in a row, a monthly decrease.

“This decrease was wide and unanimously over age, income, education, geographical region and political affiliation,” said Consumer Director Joan Hsu.

The consumer feeling decreased in April. (Photographer: Patrick T.

Fears of stagnation, and the induction uncertainty drowns in the feeling of consumer

“Feelings have now lost more than 30 % since December 2024 amid increasing concerns about the developments of the trade war that swooped throughout the year. Consumers have multiple warning signs that raise the risk of recession: expect expectations in commercial conditions, personal financing, income, enlargement, and all labor markets in the deterioration this month.”

Economic inflation

The consumer price index for March decreased by 0.1 % against February, but it has been 2.4 % annually, and remains higher than the federal reserve mandate by 2 %.

While the costs are abandoned, the prices of elements such as eggs and non -cooked beef are still high, with an increase of 60 % and 10 %, respectively.

A safe haven for gold

The precious metal witnessed some fluctuations this week, but it recovered to its highest level of $ 322.20 an ounce. The 7 % weekly gain was the largest since March 2020. Even before the wars of customs tariffs escalated, many strategies were transferred to the bullish views of the yellow metal, as well as the hedge of inflation and a traditional safe haven.

Gold recovered to the highest level ever at $ 322.20 an ounce this week. (Imaging ARNE DEDERT/DPA/AFP via Getty Images/Getty Images)

Get Fox Business on the Go by clicking here

“While traditional inflation and real tables were the main engines of gold prices, the central bank’s purchase recently emerged as the main catalyst behind the increase in current gold prices,” according to an early research observation of international commodity research in Bank of America, Franciso Blanco and Irina Chorechids. The team sees the gold of $ 3500.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| GLD | SPDR Gold Shares Trust – USD Acc | 297.93 | +5.62 |

+1.92 % |

Bitcoin

The largest encrypted currency increased by market value on Friday, hovering just over $ 83,000. However, it decreased by 21 % of its highest level ever at 106,734.51 dollars in December 2024.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-04-12 11:30:00