UK jobs market weakens as economy faces tariff hit

Stay in view of the free updates

Simply subscribe to Employment in the United Kingdom Myft Digest – it is delivered directly to your inbox.

The weakest labor market in the United Kingdom in February and March before working taxes on employers increased this month, even as wage growth remains strong, confirming the challenge facing the Bank of England as the economy is progressing for the impact of American definitions.

The employment that was formulated in salaries decreased by 8000 between January and February, according to the tax data published on Tuesday by the National Statistical Office. The number was revised from early estimates to achieve 21,000 gains.

Initial figures for the month of March indicated a larger decrease of 78,000, or 0.3 per cent of workers in the work, before this month was submitted by national insurance contributions to the highest employers in the October budget. The national living wages also increased in April.

If this is confirmed, this will be the biggest decline since May 2020, although the initial ONS numbers have been revised at a rate of 22,000 on average every month last year.

Vacancies have decreased without prenatal levels for the first time since the spring of 2021.

“Some initial evidence that companies have started responding to the rise in labor taxes and the minimum wage of this month by reducing the number of employees.” “The growth of jobs can be hit more than the last increase in uncertainty due to the development of the American chaotic tariff policy.”

The Bank of England closely monitors employment data to monitor the impact of the high tax owners and increase in the national living wages. It also pays attention to the economic impact of American definitions.

Sanjay Raja, an economist at Deutsche Bank, said that the “big image” of labor market data is that the Bank of England has a green light to reduce the bank rate in May. “The uncertainty in trade is still widespread. Stagnation in the labor market arises.”

UK companies are facing high uncertainty after US president Donald Trump’s decision on April 2 to impose an import tariff on goods from most countries.

UK exports are facing a 10 percent import tariff in the United States, which leads to economic expectations. Financial markets are pricing in Reducing Bank of England in May, with two other discounts expected by the end of the year.

Web pointed out that although employment continued to calm, “it did not collapse with the proposal of terrible warnings of some commercial investigative studies.” Despite softening the job market, “there were few signs of this nutrition with the slow growth of wages.”

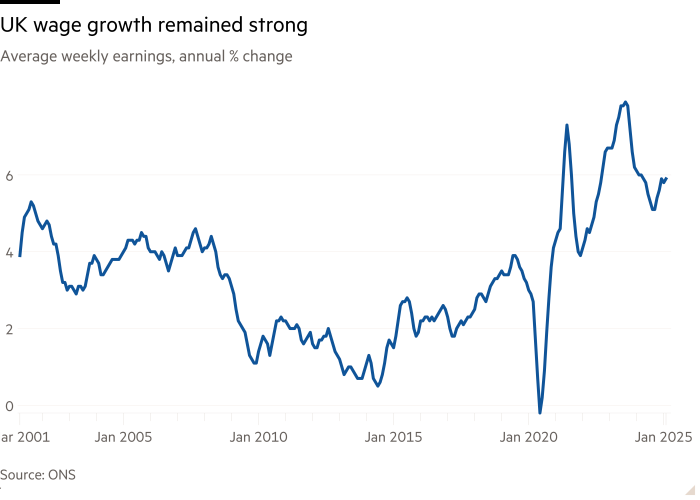

Separate data on ONS showed annual growth in the average weekly profit, with the exception of rewards, amounting to 5.9 percent in the three months to February, up from 5.8 percent in the three months to January. Economists expected a 6 percent increase.

Liz McChyun from ONS said that wage growth has accelerated in the public sector “with the high previous wages that are fully fed to our main numbers, while the wage in the private sector has not changed slightly.”

The average annual normal profit growth was 5.9 percent for the private sector, unchanged from three months to January, and 5.7 percent for the public sector, an increase of 5.2 percent in the previous period.

Web said that the pressure on inflation and activity from the US higher definitions “may mean that the Bank of England begins to become less anxious about the upward risks of inflation than wage growth and more anxious about negative risks to activity.”

The growth of the wage, regularly adjusted to inflation, has been modified by 2.1 percent in the three months to February, representing the twenty -first month of the growth growth that exceeds inflation, in a family financing batch.

The unemployment rate in the UK was 4.4 percent in this period, unchanged from the three months to January. However, the number is less reliable due to the workforce scanning problems on ONS.

ONS aims to replace the scan with an improved scan by late 2026.

2025-04-15 08:06:00