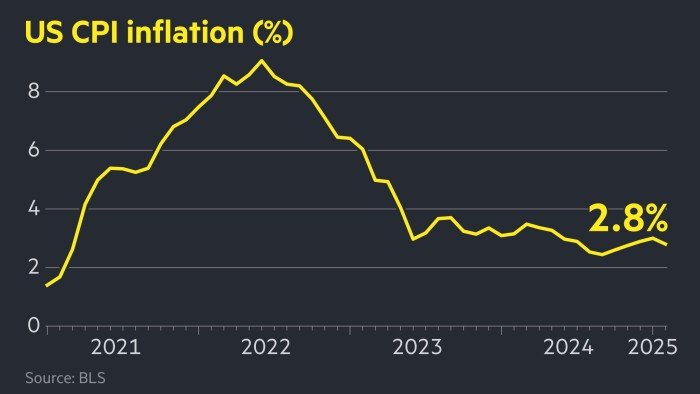

US inflation fell more than expected to 2.8% in February

Stay in view of the free updates

Simply subscribe to American inflation Myft Digest – it is delivered directly to your inbox.

Inflation in the United States fell more than expected to reach 2.8 percent in February, strengthening the Federal Reserve issue to reduce interest rates amid signs of slowdown in the largest economy in the world.

The annual consumer price index was less than 3 percent of January and 2.9 percent expected by economists, according to Reuters poll.

American stocks opened higher, but the gains later fade in the trading session, leaving the Blue S&P 500 slightly less a day.

Futures markets are pricing in price cuts this year with the opportunity of about 85 percent of the third – marginally by the data version.

The US Central Bank faces a difficult law in balance because it tries to reduce inflation without recession, amid intense concerns that President Donald Trump’s aggressive economic agenda hinders growth.

Companies and financial markets were shaken by offering chaos from the Trump tariff for the largest commercial partners in the United States, which was characterized by a series of sudden escalation and turns.

Wednesday figures showed that basic inflation increased by 3.1 percent, as it decreased to an increase in expectations by 3.2 percent.

“The basic inflation slows down before we reach these upward risks of definitions, which will come later in the spring, so this is positive for the Federal Reserve,” said Veronica Clark, economist in Citigram. “This will make them less worried about planning later in the year.”

Last week, Federal Reserve Chairman Jay Powell reduced concerns about the health of the American economy after the post -election gains were eliminated in the S& P 500 index after the release of disappointing employment numbers for February.

Powell suggested that he is expected to keep the central bank with interest rates in its current range of 4.25 percent and 4.5 percent at its meeting next week, saying that the federal reserve was not “in haste” to reduce and “focus on separating the signal from the noise with the development of the outlook.”

On Wednesday, Canada Bank reduced interest rates by a quarter to 2.75 percent, noting the expected slowdown of “increasing trade tensions and definitions imposed by the United States.”

Although she said that the Canadian economy had started the year in good condition, BOC also indicated that the economic activity in the United States and warned that its own view was more difficult to understand “more certainty than usual because of the sophisticated political scene.”

Some economists and investors fear that Trump’s tariff will enlarge inflation, at the price of many minerals, including aluminum, after the administration imposed a sharp tariff on imports from Wednesday.

The transition from the White House imposed 25 percent on all imports of steel and aluminum, rapid revenge on the European Union, which targets up to 26 billion euros of American goods with customs tariffs.

Tom Porsili, the US chief economist in Pgim, said that the February decrease was welcomed, but said that relieving investors could prove his shortness given the potential impact of definitions.

In February, the sectors that record the largest increases in prices and cars used, while the travel and new cars were among those that decreased the costs.

Egg prices, a great contributor to the powerful reading for January, was up again in February, as it increased by 10 percent a month to an annual increase of 59 percent.

“It is certainly good news, but I think we do not want to exaggerate this,” said Ryan Sowet, the American chief economist in Oxford. “The customs duties have entered into China in February and it may be too early to capture it in this round of data.”

2025-03-12 15:22:00