US stocks wipe out steep losses that followed Trump’s ‘liberation day’

Digest opens free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

American stocks rose on Friday, as they eliminated the sharp losses that followed the announcement of the “Liberation Day” tariff in Donald Trump a month ago, after the labor market data exceeded expectations.

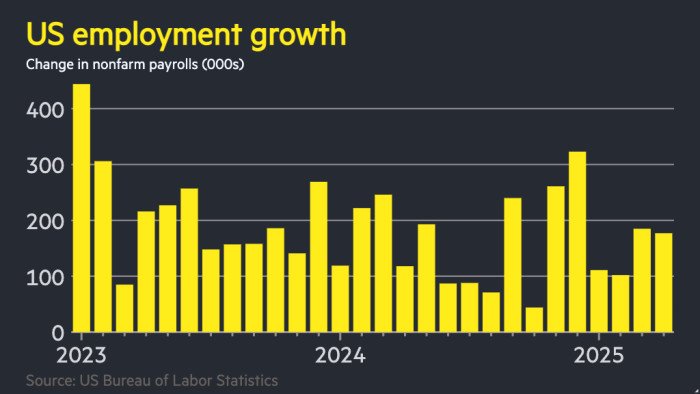

According to the Labor Statistics Office, according to the Labor Statistics Office, it exceeded the 135,000 jobs that the economists included in Bloomberg, although the number was decreased from 185,000 jobs in March.

S&P 500 jumped 1.4 percent on Friday morning, which led to the highest closing level from April 2, when Trump revealed the so -called “mutual definitions”.

The Standard Stock Index in Wall Street fell to 15 percent in several days of turbulent trading after the announcement of the American president, which led to turmoil in global financial markets.

But global stocks have since largely recovered, signs of a possible dissolution in trade tensions, including the comments of the Ministry of Commerce in China on Friday, which Washington recently expressed “the desire to participate in discussions” on this issue.

“It seems that this gathering is expected to be the worst approved,” said Ajay Rajadahaksha, the international head of research at Barclays. But he added: “In fact, it is exactly the opposite. The worst has not yet appeared in the data. Nothing has appeared in the data yet.”

Despite the recovery in stock markets, dollars are still lower than the “Liberation Day” level.

After Friday job data, the return on treasury bonds increased for two years, which tracks the interest rate expectations and moves back to prices, and 0.08 percentage points rose to 3.78 percent as investors are betting that the US Federal Reserve will keep borrowing costs higher for a longer period.

“People were afraid of a negative surprise that was not coming,” said Mike Ridel, Fidelity International Fund Director, said.

Traders in the futures market market have reduced their expectations for interest rate discounts this year, with three discounts of four instead are the most likely result.

Goldman Sachs said it paid her expectations for the next rate in June to July.

“The Federal Reserve must reduce its average !!!” Trump has actually posted on his social network shortly after the appearance of job data, praising “strong employment and more good news.”

Job figures came on Friday after the mass shooting of thousands of federal employees by the alleged Ministry of government efficiency from Elon Musk.

On Friday, data indicated that the employment of the federal government decreased by 9,000 in April and 26,000 since January.

The total unemployment rate has not changed at 4.2 percent.

Claudia Siham, the chief economist in New Consesters, said that although Trump’s economic policies were “anything hidden” its initial influence was “relatively small”.

She added that the matter will take some time for them “to work through the system, which means that the Federal Reserve will wait”, and that any discounts most likely in the second half of the year instead of the central bank meetings during the next two months.

The official data this week indicated the first decrease in GDP for a period of three years, but it was distorted due to an increase in imports before Trump’s commercial tariffs, while the local demand remains strong.

Many economists expect duties to be a traction on the basic growth in the second quarter of the year.

“In general, this is an indication that the labor market has not yet deteriorated,” said Gennadi Goldberg, head of the US price strategy at TD Securities, on Friday. “But investors are still tense that another shoe will decrease. We do not know when.”

Additional reports by Ian Smith in London

2025-05-02 15:16:00