Wall Street hires more senior bankers as growing confidence spurs deal rebound

Written by Tatiana Batuzer, Saeed Azhar and Esla Benny

New York (Reuters) -Banks have hired dozens of senior executives in the streets in recent months, as the improved economic morale of integration and subscription subsidies has pushed after the early calm of the year due to concerns about the effects of the United States.

The increase in job mobility, which usually occurs in the spring, shows how the increasing confidence of banks has pushed employees to deal with a wave of deals.

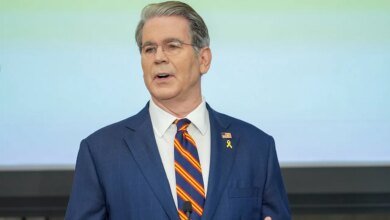

“It has been an active summer in investment banking services,” said Troy Rozoo, a participant in the Commercial and Investment Bank at JPMorgan. “But we have been employed strategically in the long term in the geographical sectors and areas where we believe we can continue to grow.”

On Friday, the veteran JPMorgan in industry appointed Jerry Lee as a global president for investment banking services, who will join his rival Goldman Sachs. The bank recently added many major banking banking, energy defense and activity and rented more than 300 bankers between January and April via its global banking unit.

“At the present time, when the employment was really supposed to start, it rocked the strong uncertainty in the customs tariffs of the markets and shook many of these banks, and thus they said” hey, let’s stop. “With the stability of the markets, employment began to pick up in July,” said Merridhyne Deni, the administrative partner of the financial research company at Brussepict Rock Partners.

Wall Street executives usually receive and think about job offers between January and April, weeks after receiving their annual rewards. But the 2025 recruitment season has stopped due to the announcement of the American definitions that President Donald Trump described “Liberation Day”.

Freezing talks on integration and purchases and capital markets. “The definitions put a difficult stop in employment and banks began to reduce their size,” said Alan Johnson, the founder of compensation consulting Johnson Associated.

In June, with the resumption of investment banking activity, the job opportunities that were suspended, according to bankers and employees.

“There was no abandonment,” Julian Bell, head of the American company at CEO, Sheffield Haworth. “It has been presented and closed throughout the year without stopping temporarily and we are still difficult to do so … It is active throughout the market.”

Among the last senior tenants, the new Citigroup heads of M & A, Guilllermo Baygo and Drago Rajkovic, as well as Pankaj Goel, was a co -chair of technology investment that all came from JPMorgan, which was rented by Viswas Raghavan President. Elsewhere, UBS added Taylor Henryx as head of integration and purchasing operations in the Americas along with a group of other additions.

2025-08-25 10:40:00