Wall Street surges following strong profits as earnings season kicks off; UBS sees ‘bull market intact’

Stocks rose on Wednesday after strong earnings reports from some of the world’s biggest names in banking and technology.

The S&P 500 rose 0.8%, after a volatile day in which it veered between a sharp loss and modest gains. The Dow Jones Industrial Average was up 254 points, or 0.5%, as of 11:30 a.m. ET, and the Nasdaq Composite was up 1.1%.

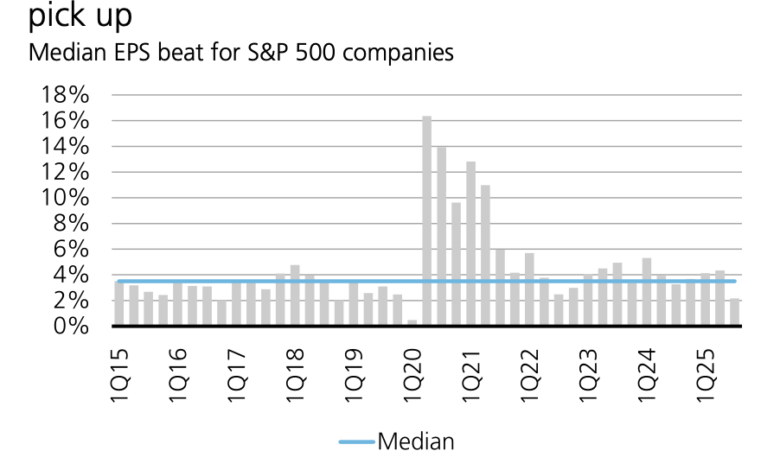

UBS Global Wealth Management issued a research note on Wednesday morning, noting the trend that companies reporting early “tend to have a good correlation with how the rest of the earnings season goes.” With just under 10% of the S&P 500’s market cap, the team led by David Lefkowitz, head of US equities, described the results as “decent”, with 80% beating sales estimates and just over 70% beating EPS estimates. This is better than usual, UBS said, but the range of these impulses is a bit soft as the average company beats earnings by 2.2%, versus the historical average of 3.5%.

Overall, UBS added, it sees the third-quarter earnings season as supporting the bank’s view that “the bull market remains intact,” driven by a combination of durable earnings growth and Federal Reserve interest rate cuts.

Technology stocks helped lead the way on Wednesday, thanks in part to an earnings report from ASML, a major supplier to the semiconductor industry. The Dutch company said it expects its revenues for 2025 to be 15% higher than last year, while next year’s revenues should be at least at the same level as this year.

“On the market side, we have seen continued positive momentum around investments in AI, and we have also seen this extend to more customers,” said Christophe Fouquet, CEO of the company. This is key when fears are high that an AI bubble may be forming, with a lot of investment flowing in similar to the dot-com craze of 2000.

Beyond ASML’s 3.3% rise in Amsterdam, Broadcom rose 3.4% on Wall Street, and Nvidia added 0.9%. Chip companies were one of the strongest forces lifting the S&P 500.

The market also helped many major banks. Bank of America shares rose 5.2% after achieving stronger fourth-quarter profits than analysts expected. CEO Brian Moynihan said every line of the bank’s business saw growth.

Morgan Stanley rose 6.4% after it also reported stronger earnings than analysts expected. This followed better-than-expected earnings reports from several banks the previous day, including JPMorgan Chase and Wells Fargo.

They helped offset PNC Financial’s 4% loss. It reported stronger-than-expected earnings for the latest quarter, but also gave forecasts for upcoming earnings that some analysts said were below expectations.

Abbott Laboratories stock fell 3.6% after its fourth-quarter revenue missed analysts’ expectations.

Companies are under pressure to deliver strong profits after their share prices rose broadly 35% from their April lows. To justify these gains, which critics say have made their stock prices too expensive, companies will need to show they are generating much greater profits and will continue to do so.

Corporate earnings reports are also under more scrutiny than usual, as investors search for clues about the health of the US economy. This is because the recent US government shutdown is delaying important updates about the economy, such as the inflation report that was supposed to arrive on Wednesday.

The lack of such reports makes the task more difficult for the Federal Reserve, which is trying to figure out whether high inflation or a slow labor market is the bigger problem for the economy.

The Federal Reserve cut its key interest rate last month for the first time this year, and officials have indicated there may be more on the way in hopes of giving a boost to the labor market. But ultra-low interest rates could push up inflation, which is already stubbornly stuck above the Fed’s 2% target.

Comments made by Federal Reserve Chairman Jerome Powell on Tuesday may have hinted that more interest rate cuts may be on the way. In the bond market, the yield on 10-year Treasury notes fell to 4.01% from 4.03% late Tuesday.

Concerns have also weighed on the market recently about escalating tensions between the United States and China. president Donald Trump has gone back and forth in his criticism of China, particularly regarding its restrictions on exports of rare earth elements, materials needed to manufacture everything from consumer electronics to jet engines.

Gold was one of the big winners due to all the uncertainty, rising 1.3% to $4,200 an ounce. It’s up nearly 60% for the year so far as investors look to buy something that could offer protection from trade wars, real military wars and the possibility of higher inflation due to the mountains of debt being amassed by the United States and other governments around the world.

In overseas stock markets, indicators were mixed in Europe after a stronger finish in Asia.

South Korea’s Kospi jumped 2.7% and France’s CAC 40 rose 2.1% in two of the world’s biggest moves.

___

AP Business Writers Matt Ott and Ellen Kurtenbach contributed.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-10-15 17:26:00