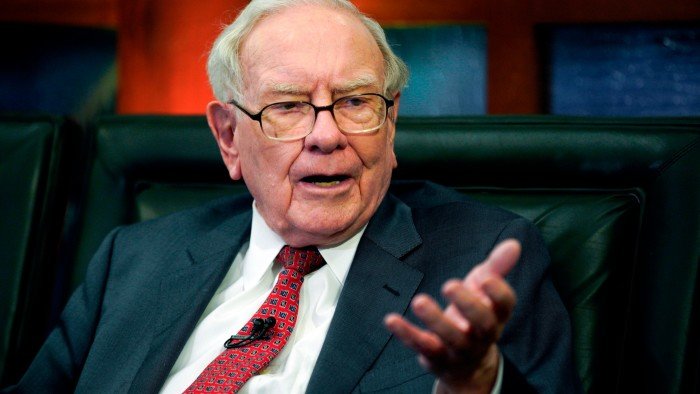

Warren Buffett to step down from Berkshire Hathaway after six decades

Digest opened free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

Warren Buffett, the most famous investor in the world, said he intends to step down from the leader of the sprawling Hathaway Group over the past six decades.

The 94-year-old, known as “Oracle of Omhaa”, said he will suggest that Greg Abel will lead Berkshire at the end of this year.

He said: “The time when Greg has to become the company’s CEO at the end of the year, and I want to dazzle this for managers and obtain this recommendation.”

Abel, 62, who was eventually called Buffett, is the deputy chief of insurance operations in Berkshire.

Puffett said that the other ABEL or Berkshire managers did not give any prior notice, making the announcement at the end of a meeting annual shareholders in Omaha, Nebraska.

Berkshire is one of the largest clumps in the world, and it runs a group of about 200 companies. It took Pavite in 1965 when the textile maker was medium -sized.

Buffett is planning to hold a meeting on Sunday with Berkshire’s Board of Directors to answer questions about his decision.

“Two directors who know my children know what I will talk about,” he said. “For their rest, this will come as news.”

He added, “He will continue to hang and can be useful in a few cases,” but the entire scarf must pass to Abel.

A crowd of tens of thousands of shareholders who went down to this event broke out to applause after the announcement.

“The investment official in Berkshire, C.”, said. Stern and Partners, through tears, leaving the square on Saturday afternoon: “This is completely enormous.”

“Berkshire Hathaway is an incredible act and incredible achievement. It represents everything better than American capitalism and entrepreneurship.”

Buffett step down. Berkshire A-the separation that Pavit himself and many of his first investors-closed at a record price of 809,808.50 dollars, which is the price that reflects not only his long-term investment success but also the cash flow from Berkshire’s operational works.

The stock has increased by 20 percent since the beginning of the year, while the S& P 500 index decreased by 3 percent.

Puffett reassured the shareholders that even though he no longer led the bloc, he was holding his forms in Berkshire. “I have no intention – zero – to sell one share of Berkshire Hathaway,” he said. “I will gradually abandon it.”

Berkshire now earns a lot of its money from the wide insurance business, which includes companies such as GEICO, as well as countless companies from space manufacturing to railway to chocolate stores. The textile works were closed in 1985.

Although among the richest individuals in the country with a value of about $ 168 billion, according to Forms, Pavit has maintained the aura of people, and attracted the shareholders annually to Umaha for the weekend of the celebrations. He still only takes a symbolic salary of $ 100,000, as he did for more than 40 years.

The death of his friend and his commercial partner, Charlie Monger, increased in 2023 from speculation about when Buffett may step down. Saturday afternoon in Omaha, the answer finally reached.

“This is the news hook for today,” said Buffett, a muffled laugh.

2025-05-03 18:41:00