White House quietly mulls millionaire tax hike as House GOP leaders object

White House assistants are quietly floating a proposal within the House of Representatives that would raise the tax rate for people who receive more than a million to 40 %, and they are aware of the discussions that told Fox News Digital, to make up for the cost of eliminating advice on paying additional work, retired social guarantee, and social guarantee of retirees.

The sources stressed that the discussions were only preliminary, and the plan is one of the many who are talked about as Republicans in the Congress are working to advance the agenda of President Donald Trump through the reconciliation process in the budget.

Trump and his white home did not take a job in this regard, but the idea is seen by his assistants and employees in the Capitol Hill.

Meanwhile, the Republican Party leaders, including parliament Speaker Mike Johnson, were opposed. The idea of any tax height.

Trump is open to send violent American criminals to Al Salvador Prisons

Speaker Mike Johnson is working to pass President Trump’s agenda through the budget reconciliation process (Getty Images)

Johnson said on Sunday morning: “I am not a great fan to do so. I mean, we, the Republican Party, and we are to reduce taxes for all,” Johnson said on Sunday morning.

One of the legislators in the Republican Party asked about the proposal and the not to disclose his identity by speaking, frankly, that they will be open to his support, but they prefer a starting point above one million dollars.

They said that the reaction was “mixed” between other Republicans in the House of Representatives. But not all legislators of the Republican Party at home are familiar with the discussions, and it is not immediately clear how much the proposal was presented.

However, it indicates that Republicans are deeply divided around how Trump’s tax agenda works.

Learn about the legislators who chose Trump Giving the spokesman Johnson the full Republican party conference at home

The expansion of the TRABT tax cuts law and its latest tax proposals is the cornerstone of Republican plans for the budget settlement process.

By reducing the Senate threshold from the passage of 60 votes to 51 votes, it allows the party in power to collect the opposition to pass a part of the full legislation that is advancing its own priorities – provided that measures deal with taxes, spending or national debt.

The extension of Trump’s tax cuts will cost trillion dollars alone. But even if the Republicans use the budget account to hide its costs, known as the current political foundation line, they will have to find a path forward for the new policies that eliminate taxes on advice, additional work wages, and social security checks for retirees.

Long -distance taxes on the wealthy can work to put the Democrats in a difficult political situation in forcing them to choose between supporting Trump’s policies and opposing the idea that has pushed it for years.

The majority leader in the House of Representatives, Steve Scalez, opposes the raising of taxes on the wealthy (Reuters/Mike Cigar)

The current income tax rate is about 37 % at 609,351 dollars in profits for one person or $ 731, 2012 for couples.

But raising the price of millionaires can be one way to pay the new Trump tax policies.

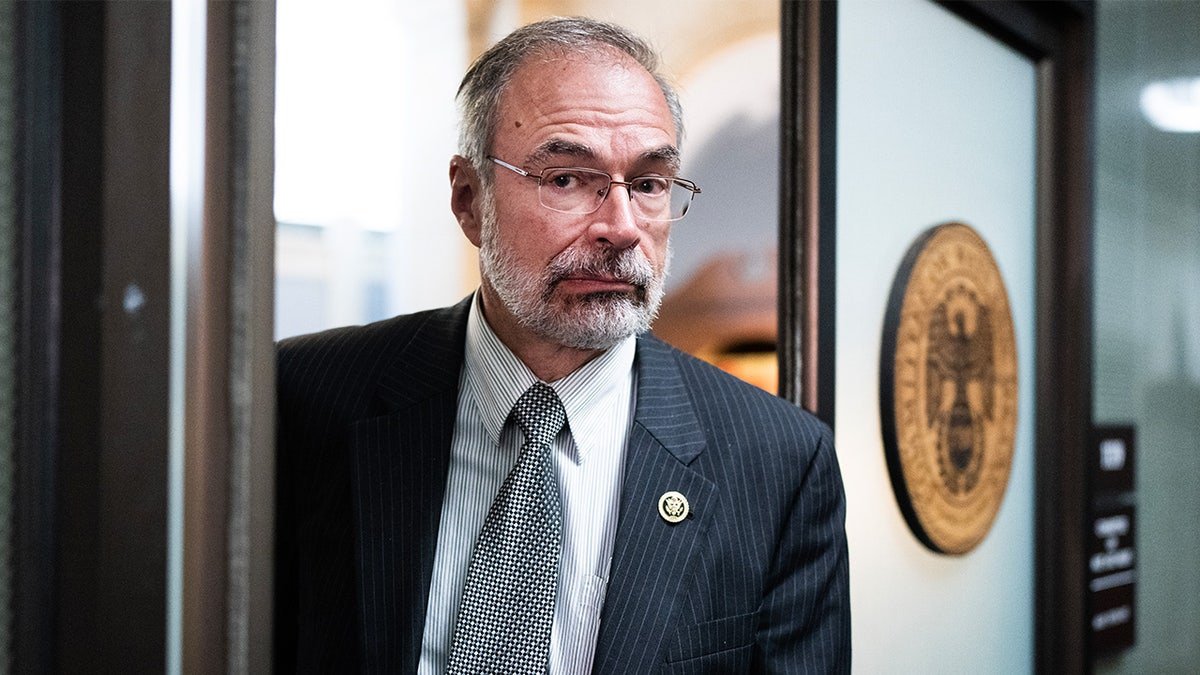

House Freedom Caucus Andy Harris, R-MD, said. , One of the reverse hawks that leads the charge to ensure the new spending pair with deep discounts elsewhere, “This is one of the possibilities.”

Harris told “Al -Sabah with Maria” last week: “What I would like to do is that I really want to find spending cuts elsewhere in the budget, but if we cannot get enough spending discounts, we will have to pay the price of our tax discounts,” Harris told Al -Sabah with Maria last week.

“Before the tax cuts and jobs law, the highest tax chip was 39.6 %, and it was less than a million dollars. Ideally, what we can do, again, if we could not find discounts in spending, we say” well, let’s repeat this higher arc, let’s put it in income the amount of $ 2 million and above, “to help pay for the rest of the wings.”

But Johnson No. 2, the majority leader of the House of Representatives, Steve Skaliz, R. La. , Pour the cold water again on the idea on Tuesday.

“I do not support this initiative, although it added,” everything is on the table, “Skalis said.

Andy Harris, Chairman of the Freedom Board of Directors, pointed out the idea (Getty Images)

“For this reason you hear all kinds of ideas that bounce around it. If we do not take any action, you will have more than 90 % of Americans see a tax increase,” Scalise warned.

Bloomberg News was the first to report the proposal to raise taxes by 40 % of Republicans.

Click here to get the Fox News app

When it was reached for the comment, the White House referred to Fox News Digital to the comments of the secretary secretary Caroline Levitte on Tuesday when it said Trump had not decided on another proposal to raise the company’s tax rate.

“I saw this idea proposed. I heard this idea discussed. But I don’t think the president made a decision on whether or not he was supporting it,” Levitte said.

Fox News Digital has also arrived at Johnson’s Office for Comment.

Don’t miss more hot News like this! Click here to discover the latest in Politics news!

2025-04-16 00:03:00