‘I wouldn’t do anything nearly so noble’

-

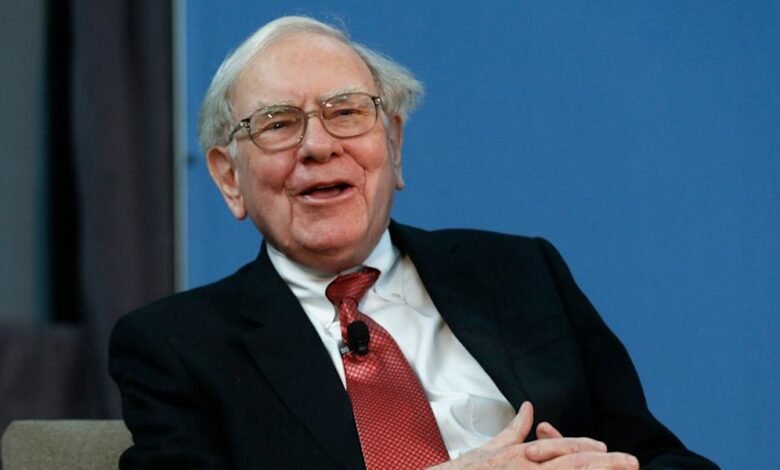

Warren Buffett said he did not build a huge stake in his planned successor.

-

The billionaire mocked that he would only do a “noble” to make Greg Abel look good. “

-

The Hathaway Berkshire Reserve doubled more than $ 300 billion in 2024 and rose in the last quarter of the last quarter.

One of the biggest questions hanging on Berkchire Hathaway is the reason that Warren Buffett has built a large cash reserve.

The famous investor and CEO of Berckshire rejected the idea that he was setting up a large amount of money, treasury bills and other liquid assets for his planned back, Greg Abel, to invest as soon as he left.

“I will not do almost anything to the extent that I have been withholding investment myself so that Greg can look good,” said at the annual shareholders ’meeting of Burkechire on Saturday.

The company’s profits on Saturday showed that Berkchire has doubled a cash stack to the north by $ 300 billion last year, and rose to a new record of about 348 billion dollars in the first quarter of this year.

One of the big factors in the increase was the sale of Berkshire for two -thirds of its location in Apple last year, which was its largest portfolio for years. Pavite still praises Tim Cook, CEO of Apple, who was sitting just a short distance from him in the crowd at the Chi Health Center, where Business Insider was watching the procedures directly.

Puffett said that he will spend $ 20 billion, up to $ 100 billion, on the right opportunity if a company or any other assets provides good value and feel comfortable in the long term.

The high assessments of public shares, private companies, and even the valuable Berkshire shares have been foiled in recent years.

The billionaire said it prefers whether there are sufficient deals offered that Berkshire will only have $ 50 billion in reserves. But he said that it would be “the stupidest thing in the world” to constantly invest 50 billion dollars annually just to reduce the Berkshire’s monetary pile, as quality purchases only appear at times.

He also emphasized that he may have already been active in the market over the years.

“Charlie always thought I did a lot of things,” Buffett said, referring to his late commercial partner, Charlie Monage.

Read the original article on Business Insider

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-05-03 22:16:00