You won’t get more money from quitting in this economy, BofA says, as job-hopping freezes in white-collar America

Functional hubbuber and job presenter: two distinct types, with one in hibernation as the other appears. Bank of America’s latest research shows that the Job Job era-with specified species in the labor market during the resignation of the great epidemic-quickly faded. Bofa finds that Hobper is 2022, and although it does not use the phrase, the report constitutes additional evidence that 2025 is the peak “hoggger”.

The Korn Ferry Consulting Company found earlier this month that the 2025 profession climate has workers adhering to their jobs “for dear life”. This analysis followed a terrible report of jobs from the July Statistics Office, which has reviewed the previously previously lower estimates of job growth in May and June. Besides president Trump, the head of the office is fired immediately, the economy confirmed with the growth of minimal jobs.

“Given all the activity that occurred after the stage after that, then some of these continuous hairstyles, people wait and sit in the seats and hope they will have more stability.” luck About the rise of migrants. “No one wants to leave unless he is not very happy or miserable in his job or is very anxious about the company.”

Bofa says it is difficult to measure Bofa, but they are an important part of the total labor market image, and data shows a clear decrease in the peak of great resignation. Bofa finds that job mobility is still higher than prenatal levels, but this was a completely different economy, as only 3.5 % of unemployment (less since 1969) and a very narrow work market. In the past, that was the end of a long period of economic expansion, with high job stability and urgency to change jobs, before the epidemic changed the image significantly.

Great help from “Mah”

BOFA research used the unknown and unknown deposit account data across millions of customers to track the “J2J” movements, and to determine the rate by determining changes in salary statements within the deposit accounts. It is in line with federal data from the Jolts Survey, which tracks the “take off” rate every month, indicating that the rate of adherence in July was the lowest level since December. After publishing it on Bluesky, the chief economist Glassdooor Daniel Zhao wrote that the report “shows more soft numbers with hiring and worrying prices are still slow. Not imminent, not amazing, more than him.”

Talk to luck About the general situation of the labor market in a new interview, Zhao said that Glassdooor data shows that “more and more workers sit in their roles and feel that they are stuck as a result.”

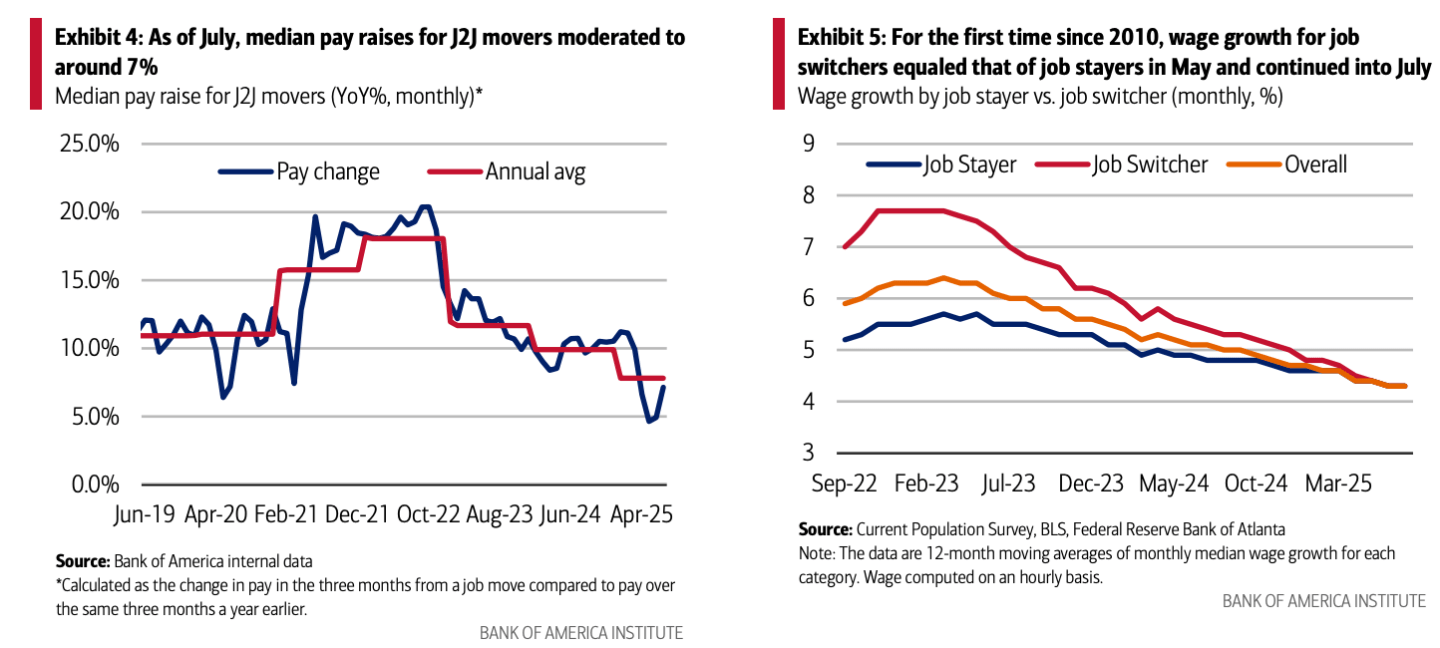

Bofa’s latest report found that the J2J movement decreased sharply from its peak 2022, which is now only 2 % higher than prenatal levels, as the reckless was heading down most of the past year. The wage increases have collapsed for job operations, as well, with wages increased from 20 % in 2022 to 7 % only from July 20, until it decreased without average 2019. BOFA cited data from the Federal Reserve in Atlanta that turned out to be from May to July, wage growth for jobs related to jobs equivalent to small jobs; The last time this happened in 2010, during the lukewarm recovery of the great stagnation.

Cold from white collars

Bofa’s granular salary analysis analysis reveals that changing jobs has been widely cooled in industries such as financing, information and business services, where monthly wage periods are prevalent and that job moves are rare. Meanwhile, job changes are still a little stronger in industries including manufacturing and construction, as they keep weekly wages and constant display issues of employment modestly. But in general, with the receipt of the rate of functional variables for monthly wages and wage per week, it exceeds other species, “white job employment” disappears faster.

This does not mean that the workers are satisfied. A report issued by Glassdooor found that 65 % of employees had reported their feeling that they were “stuck” in their jobs, which implicitly means that they want to take over the job but they were unable to do so. The quit smoking and the disengagement is increasing, as Gallup estimates that the disengagement costs the global economy $ 438 billion in 2024. The executive rotation adds to uncertainty, as the CEO has recorded record levels and is informed by a roundabout at the top. For many, the job deficit is to survive, not loyalty.

Children are not fine

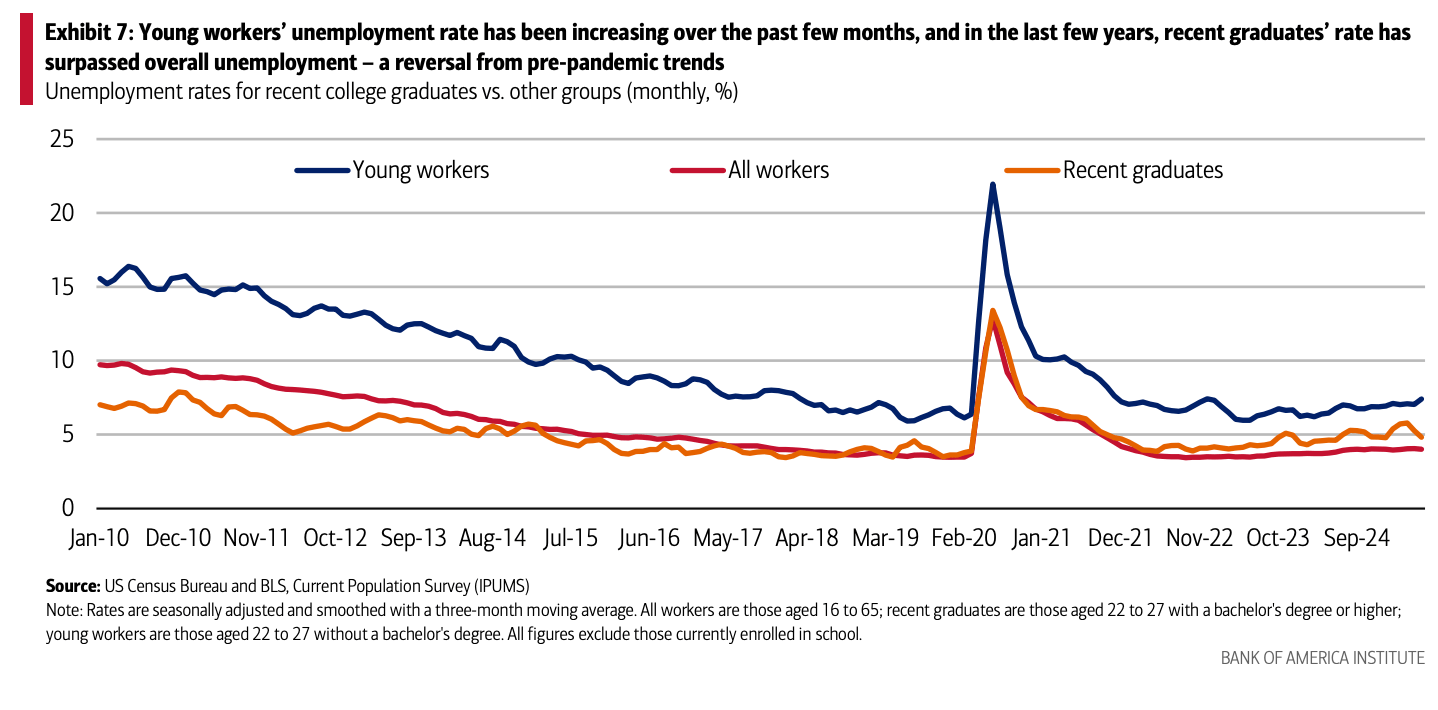

To finish its report, Bofa enlarged to look at the younger workers and the Gen Z, noting that more than 13 % of unemployed Americans in July were new competitors or those looking for jobs without experience in previous work, which give Gen Z. the highest since 1988, according to Richmonm Fed. It is concerned that the unemployment rate for young workers continued to rise, as it reached 7.4 % in June.

Quoting research from the International Labor Organization, Bofa argues that young people have been exposed to higher employment losses than older workers and left their studies due to education and training disturbances during work. Bofa has a special scanner that finds young generations more likely to be negatively affected by the factors related to work/employment.

Global Research Bank of America

In general, the bank estimates that “about 289 million young people in the world do not gain professional experience through a job or development skills by participating in an educational or professional program, which limits economic gains.” Bofa sees the low -term recruitment prospects for young workers in the medium term, given the uncertainty of the new definition system, the adoption of artificial intelligence, and general withdrawal on beginners sites.

In this economy, then, the dodgers are betting that there is no better opportunity there, and that young workers find themselves abroad looking. Bofa does not display any scenarios in stagnation, but with the economy stopping job boats, the issue operating in a roasted white position.

2025-08-25 21:09:00