You’ve heard that gold is hitting record highs. Not quite, BofA says

Gold prices have already rose to the highest level ever in 2025, prompting newspaper headlines around a historic gathering. But according to the global research at the BNKAA (BOFA), the story is more accurate: the gold sector, despite its prosperity, is no longer to all the standards that defined the previous periodic peaks, especially with regard to its value in relation to the broader stock market and its historical assessments.

This year, gold rose the main thresholds, as the traditional hedging against inflation was pushed and total economic certainty due to the large number of Mondays. On September 2, gold paid $ 3500/ounces, climbing more than $ 3,600/ounces on Monday after the disappointing US job data for August, which raised bets on an easier monetary policy. They say the Bofa Commodities team is “upward”, and they now expect the average quarterly price to reach $ 4000/ounces in the second quarter of 2026, as the immediate price has already increased by 4.1 % a week to $ 3589 within.

Rob Haworth, Chief Investment Strategy in the United States of America, he said luck In March, this gold may be a good investment for some, but it is not completely liquid. “You do not send gold to buy your Domino pizza,” he said, adding that the Gold Rally in recent years has been driven by central banks that buy precious metal with weakening the US dollar and countries like China are seeking alternatives.

Here is the reason that Bank of America says that the perspective is important in assessing the high gold record, and this depends on how you view it.

The market sector doubles the peaks of the past, but …

The total market value in the global gold sector has increased to a little more than $ 550 billion, or nearly twice the sums of which were seen in 2011 and 2020 (331-334 billion dollars), more than 8x in the 2016 session ($ 70 billion), and more than 3x in the last session of 170 billion dollars in 2022. But also the benefit of the investor is in addition to inflation and the costs of the sector cost.

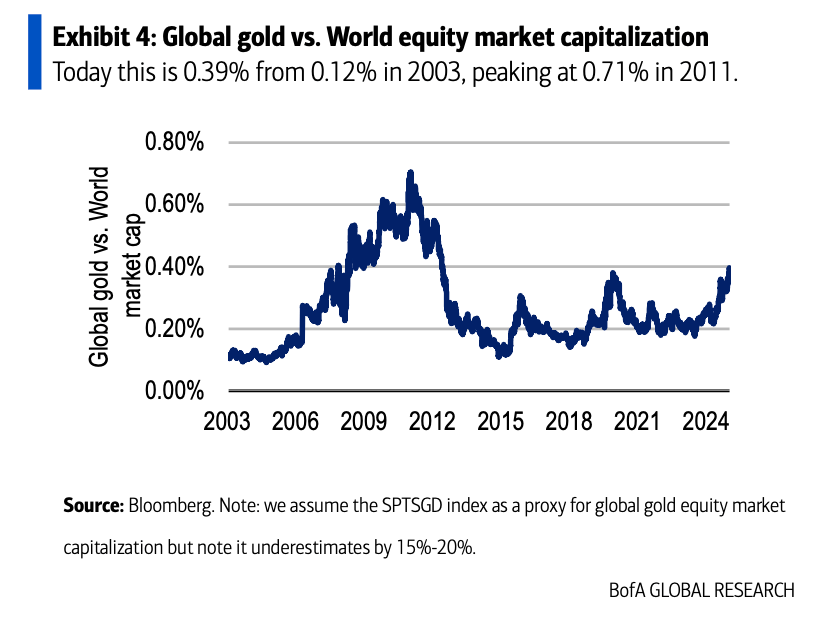

However, when it is seen as a share of the total global stock market, the rise of Gold’s appears less dramatic, which is “much less” than its previous highest levels, says the commodity team. This sector is now 0.39 % of the global market value, and it corresponds to the peak of 2020 but is still much lower than the height of 2011 of 0.71 %. If the sector returns to the 2011 ratio, this will ask the maximum market of about 990 billion dollars – a possible trend only if the cycle continues for a sufficient period.

Running room

Despite the high prices of minerals, golden stocks are not traded with the highest historical reviews. The next sector sector sits from 12 months (NTM) Multiple at 11x, much lower than the peak 2020 at 15.4X. The value of the price to the assets (P/NAV) for the sector is located at 1.88X, compared to 2.27X in 2020 and 2.19X in 2011. The current instant gold prices were modified, where complications of the sector indicate more bullish direction, with NTM EV/ebitda at 11.7X and P/Nav at 1.39X.

Golden stocks responded to the price collection, but not uniformly. The main indicators such as the S&P World Gold (+5.5 % WOW), the Philadelphia Gold and Silver Index (+4.8 %), and the NYSE Arca Gold Bugs (+4.1 %) index (+4.1 %) all of them besides the outbreak of alloys. A year to another, Freshnillo is the best performance, climbing more than 268 %, and lights lights with different returns in this sector.

BOFA research indicates a growth space – if current trends in monetary policy, inflation and investor morale persist. However, the gold sector remains a small slice of global stock pie, with stock assessments much lower than the highest historical levels. For market monitors, the high price of gold is only part of the story; The basics indicate that this mutation is not after the restart of the previous summits, and “standard levels” should be found in the context.

For this story, luck The artificial intelligence is used to help with a preliminary draft. Check an editor of the accuracy of the information before publishing.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-09-16 19:51:00