US stocks close higher, Treasury yields soften as tariff deadlines, earnings loom

Written by Stephen Collip

New York (Reuters) -Street shares advanced on Monday, while the treasury revenues eased at the summit of a crowded week of corporate profit reports, as customs tariff negotiations between the United States and its trading partners increased in the face of the final date of the rapid decline on August 1.

All three major stock indicators in the United States rose in opposing their European counterparts, gold increasing for five weeks, and placing the dollar on the yen in the wake of the weekend elections in Japan. [.N]

Telecommunications and destructive technological momentum shares provided a lot of upward muscles.

The profit season is transmitted in the second quarter to a high degree of equipment this week, and includes the alphabet and Tesla, which are from the wonderful stocks of “seven”. IBM and Intel are a high -level technician who are expected to reach within a crowded week that also includes a group of industries, from General Motors to Union Pacific.

“We have had optimism about trade, early days, but we have good profits so far,” said Zakari Hill, head of the governor’s administration at Horizon Investments in Charlotte, North Carolina. “So it looks like a summer environment, don’t fight at the moment.”

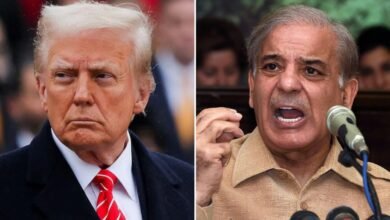

Trade negotiations have not yet resulted in any meaningful deals, as the hour indicates the deadline for tariffs on August 1 for US President Donald Trump.

Hill added: “The market’s point of view is about who hurts the definitions that have been afflicted with more or less, definitely faded and declined during the past two months.” “It was a troubled kind of news flow, I think many investors have seized it.”

“This does not seem to be the case when you look abroad to other markets.”

“I think what we have to do is to examine the entire Federal Reserve and whether it is successful,” US Treasury Secretary Scott Payette told CNBC. It raises concerns about the independence of the central bank after the reports that Trump is considering shooting Jerome Powell.

“This is very motivated, and Minister Bessin, as well as President Trump, has an appreciation and understanding of the enormous chaos that he will get an independent chaos, or attempts to shoot Powell on the market, and I do not think this is their goal or desire,” said Oliver, First Vice President of Wales Advisors in New York.

The Dow Jones industrial rate decreased 18.66 points, or 0.04 %, to 44323.53, S&P rose 500 8.89 points, or 0.14 %, to 6,305.68, and the nasdaq boat rose 78.52 points, or 0.38 %, to 20,974.18.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-07-21 00:44:00