Precious Metals Rally as Gold Nears New Highs

Via a mineral mine worker

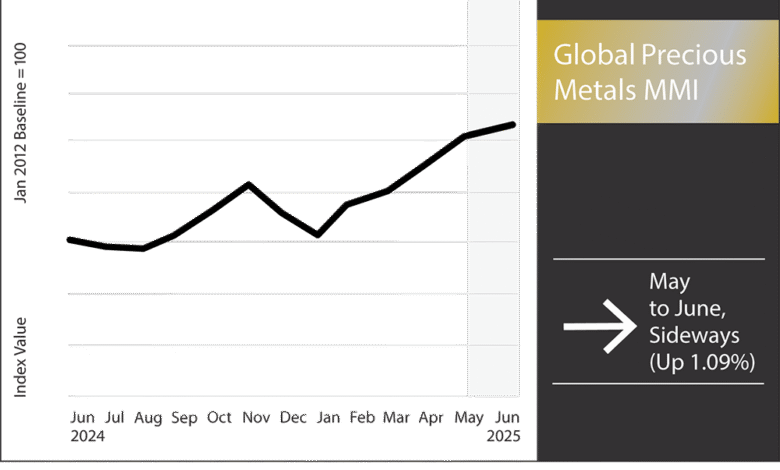

The precious global minerals MMI (monthly metal index) witnessed a strong gathering from mid -May to mid -June. Climbing precious metal prices such as gold, silver, platinum, and baladium are all on a strong mixture of safe investment flows and strong industrial demand. Geopolitical tensions, especially the recent glow in the Middle East between Israel and Iran, have only destroyed more risk. This still pushes the safe demand to gold and silver.

Adeium has improved from its lowest levels in the spring, but it continues to fail other precious metal prices due to the narrower demand profile mainly. While this represents a modest recovery, palladium remains much lower than its peaks for a few years. The main issue is to reduce demand. More than 85-90 % of the use of palladium in the incentive transformers of gasoline cars, which is still under pressure with the acceleration of EV sales.

Source: metalminer insights

Even within the combustion vehicles, some car manufacturers reduce phraftum loads or replace platinum to reduce costs. On the side of the show, palladium has faced a chronic deficit for most of the past decade. However, this seems to change. After 13 years of deficiency, it is expected that 2025 is expected to be almost balanced in paidium supplies and demand.

Investing in gold

Unless an unexpected disorder occurred in the offer (for example, mining issues or sanctions that affect major producers in Russia), it is possible that palladium is related to the range. Some downward pressure can appear if the production of cars weakens more. Palladium purchase teams may want to adopt a more manual purchase approach or consider replacement strategies, and topics that are frequently covered in free knowledge resources in metalminer.

The platinum was a prominent performer in the precious complex, where prices were climbed monthly. Unlike gold and silver, platinum strength is closely related to demand and manufacturing dynamics. On the side of the show, the platinum market swings to a large deficit this year. Senior analysts in the Johnson Mathi project that platinum supplies will decrease to a third consecutive year in 2025.

This bound supply, along with modest recycling flows only, continues to tighten the market. Metal strategy in general expects that platinum will retain and potentially extend its previous gains. “Platinum will retain recent gains and can rise a little further as a gold and silver gain,” one analyst notes, focusing on the various demand for metals as explained by Reuters.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-06-19 18:00:00