This ‘economic sugar high’ won’t last, CRFB warns, touting analysis predicting long-term stagnation and $600 billion of annual borrowing through 2028

The CRFB Federal Budget Committee (CRFB) warns that the United States is suffering from the “high economic sugar” that will not bear, noting a new analysis of the recently -old law of the law (OBBA).

According to the detailed evaluation of the non -party budget control Authority, OBBA will offer a large boost for the recent economic output, with estimates showing that growth rates can rise by about 1 % in 2026, driven by increasing demand and one -time incentive to work and investment. However, the organization confirms that this explosion of activity is transient and warns of long -term growth will run with additional borrowing. “High economic sugar does not mean continuous growth,” the tank has announced research.

How OBBA moves short -term gains

The analysis highlights many of the mechanisms through which obbba will stimulate growth in the short term. This includes the government’s borrowing 600 billion dollars annually from 2026 to 2028, discounts in business and investment, and temporary incentives expansion of companies. These policies are expected to create an increase in demand and a temporary increase in workers and capital, but CRFB confirms that these once effects will fade quickly with the amendment of the economy-especially if the full employment continues.

CRFB notes that OBBA supporters have argued that the law will greatly accelerate economic growth, including the Economic Advisors Council at the White House and Trump himself on the social truth. This will be true in 2026 and 2027, says CRFB, says, In the short term Economic growth will already be enhanced, however Sustainable Economic growth will not.

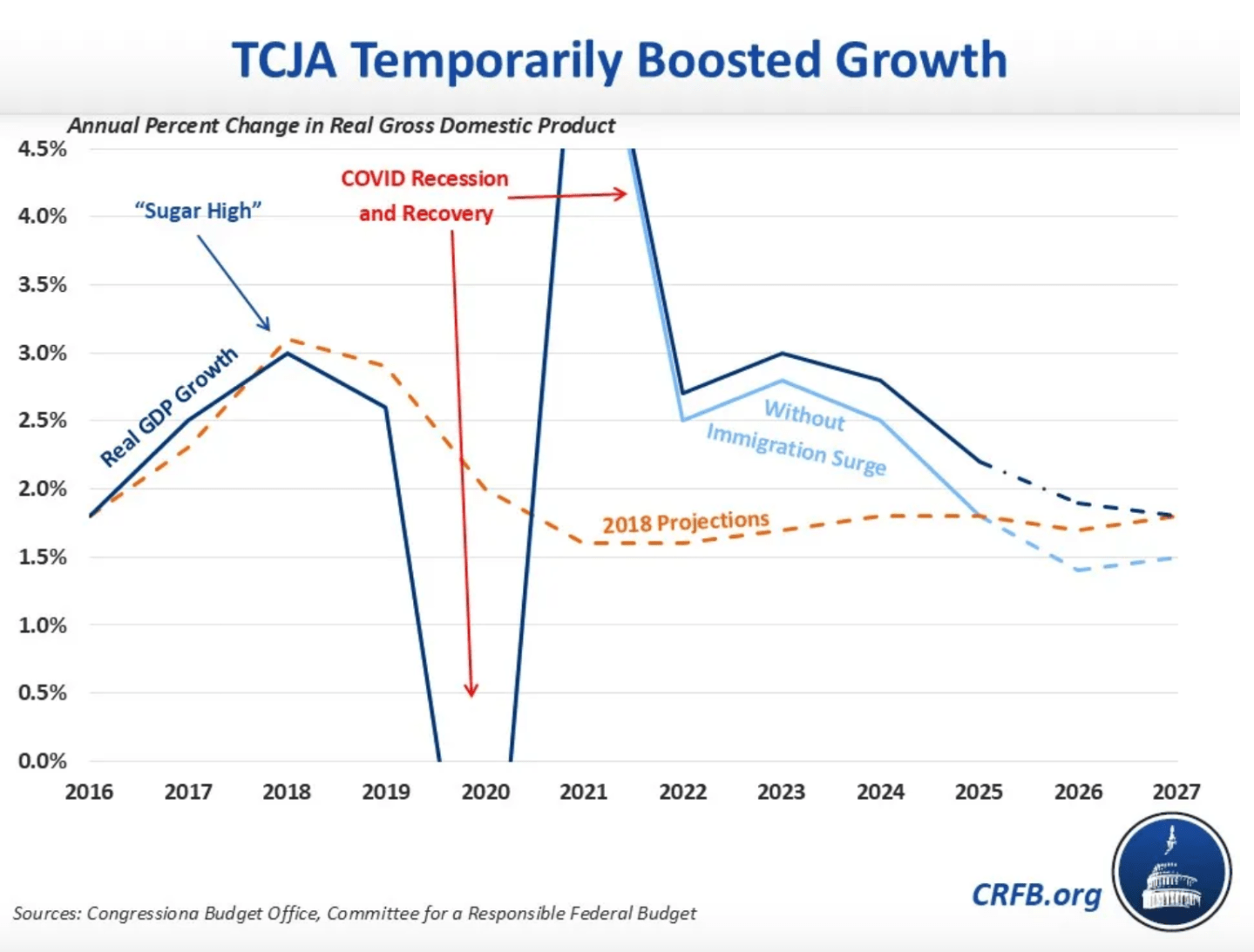

CRFB warns that the positive economic effects will be shown over time through the rise in national debt, which is expected to grow by $ 4.1 trillion until 2034, which increases investment and pressure on long -term growth. The analysis notes that support for growth is similar to previous episodes such as the 2017 tax cuts and jobs law, which provided a preliminary lifting of the economy but failed to achieve permanent growth.

Predictions decreased signal revenue

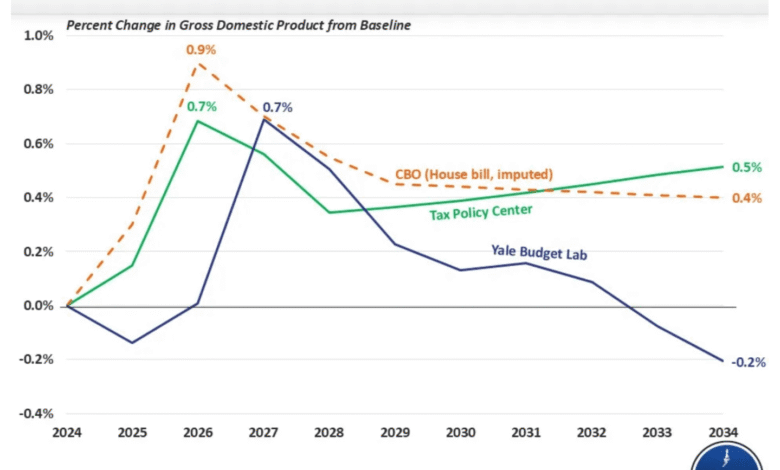

CRFB cited estimates from the tax policy center and the Yale Budget laboratory as largely agreed with its own conclusions. Its models increase OBBA’s economic output by 0.7 % -0.9 % in 2026, but growth rates come back quickly after that. In some models, the economic product may decrease by up to 0.2 % by 2034.

Congress budget office and other thought tanks predicts only modest or negative effects in the long run, despite strong immediate stimulation. (CRFB notes that the Central Bank of Oman has not issued an estimate of final legislation, but it issued a dynamic degree from the previous parliament version of the draft law.)

CRFB notes that the Economic House of Economists expects a similar pattern of the near -stimulus batch of approximately 2.4 % and an increase of 4.75 % in GDP in 2028, as it decreased to 2.55 % by 2034. Among the other two estimates, tax production on the growing output increases 1.25 % in 2034, while the Penn model is that the Penn model Whaton will lead to 0.2 production in it.

CRFB has repeatedly refers to the temporary “Sugar High” from OBBA and compares it directly with the rise of other sugar: cuts and jobs law in 2017, or TCJA, from Trump’s first state. He said that the growth that resulted from this law now appears in the past “may represent one time for economic activity rather than a continuous increase in the rate of economic growth.” Almost as expected, the economy grew by 3 % in 2018, by 2.6 % in 2019, before appearing in its course growing by approximately 2.2 % in 2020. This was of course stopped by the epidemic, with historical contraction, followed by historical expansion immediately. On average, though, GDP has grown by about 2.3 % annually since 2019, where CRFB estimates a growth rate of 2.1 % if not due to an unexpected increase in immigration that enlarged workforce. In other words, high sugar. CRFB also: Also:

CRFB ends with the call to focus on sustainable financial reforms, such as the amendments studied on taxes, regulations and benefits. More importantly, it calls for a reliable strategy to restrict national debt worth $ 37 trillion, warning that without such changes, economic tinnitus will follow years of recession. Dow Jones Industrial Meverugal recorded its latest level on August 22, 2025, while the S&P 500 was hovering near the same record levels throughout the month. However, the markets were shook shortly by selling technology amid fears of a bub in artificial intelligence in the middle of the month.

For this story, luck The artificial intelligence is used to help with a preliminary draft. Check an editor of the accuracy of the information before publishing.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-08-27 18:24:00